从个股表现来看,剔除2017年12月份以来上市新股,2018年实现上涨的个股数量仅214只,占比仅6.23%,也就意味着,2018年下跌个股超过了九成。值得注意的是,今年A股的十大牛股没有一只涨幅超过100%,这是自2005年以来,首次出现的情况。

In terms of stock performance, excluding new stock listings since December 2017, the number of shares that increased in 2018 was only 214, or only 6.23 per cent, which means that the share fell by more than 90 per cent in 2018. It is worth noting that this year, none of Unit A’s ten major cattle shares increased by more than 100 per cent, for the first time since 2005.

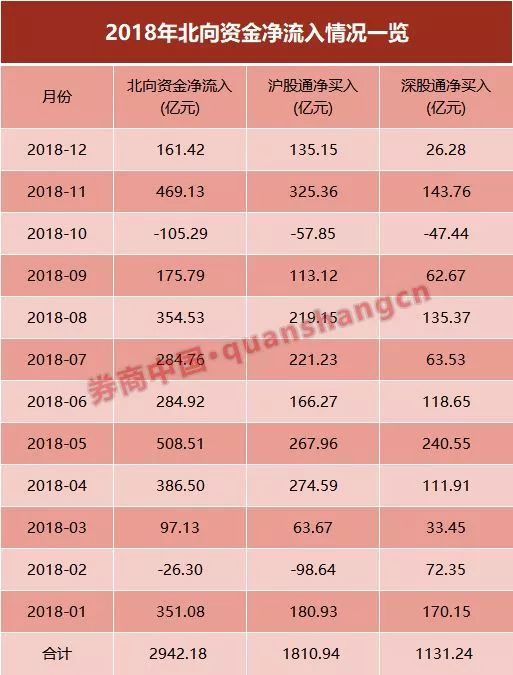

虽然A股今年表现较差,但是外资对A股的喜爱不减。数据显示,2018年北向资金累计净买入2492.18亿元,创历史纪录,只有在2月份和10月份北向资金出现就流出情况,其余月份均是净流入。

Although Unit A performed less poorly this year, foreign investment favoured Unit A as much as it did. The data show that the cumulative net purchase of $24,92.18 billion from the North in 2018 was a record record, with only Northward outflows occurring in February and October, and net inflows for the rest of the month.

2019年A股市场即将起航,我们先来看一份乐观数据:

In 2019, when the A share market was about to sail, we began by looking at optimistic data:

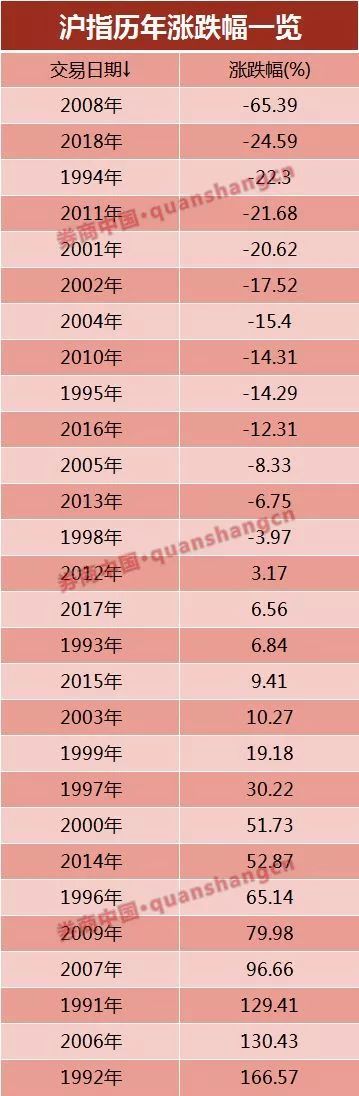

A股市场有着逢8必跌逢9必涨的历史数据,1998年、2008年、2018年,指数都是下跌的,分别下跌3.97%、65.39%、24.59%。逢9的年份,1999年、2009年,股市都是上涨的,分别上涨19.18%和79.98%。

In 1998, 2008, 2018, the index fell by 3.97%, 65.39% and 24.59% respectively. In 1999 and 2009, the stock market rose by 19.18% and 79.98%, respectively.

祝愿2019年,A股雄起!

May the ace rise in 2019!

A股创历史第二差表现

A is the second-largest performer in history

从沪深交易所核心指数全年表现来看,各大指数均呈现下跌态势。具体来看,中小板指下跌37.75%,深证成指下跌34.42%,创业板指下跌28.65%,沪指下跌24.59%。

Each major index shows a downward trend in its performance throughout the year. Specifically, the mid-sized and mid-sized index points down by 37.75 per cent, the bottom line by 34.42 per cent, the start-up panel by 28.65 per cent and the bottom line by 24.59 per cent.

沪指这一跌幅创下了A股史上第二差表现。数据显示,2008年沪指全年下跌65.39%,系A股市场第一大年跌幅;2018年沪指以24.59%跌幅位居跌幅榜第二;沪指年跌幅超过20%的还有三个年份,分别是1994年、2011年和2001年。

According to the data, the fall fell by 65.39% in 2008, the first year of the A market; the fall by 24.59% in 2018, the fall by 24.59%; and the fall by more than 20% in three years, in 1994, 2011 and 2001, respectively.

全球股市普遍下跌,A股跌幅居前

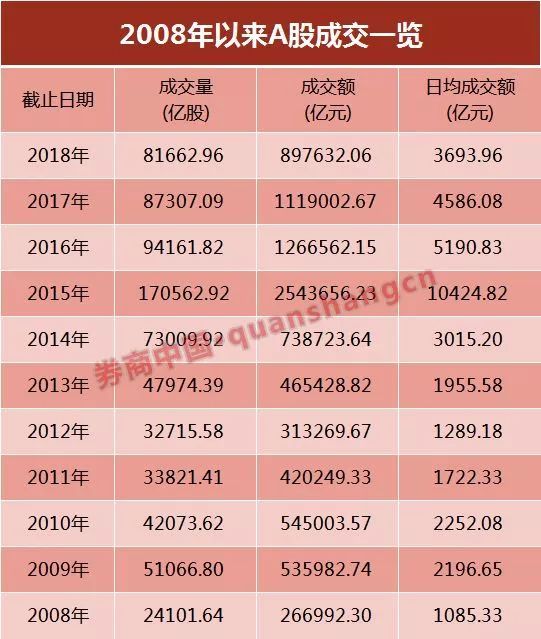

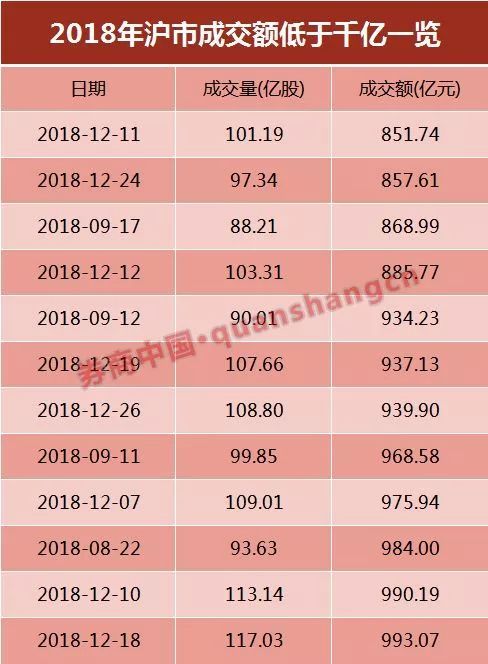

全球市场来看,2018年是风雨交加的一年。 In the global market, 2018 was a year of wind and rain. A股市场跌幅最大,深成指下跌34.42%位居首位,沪指下跌24.59%位居第二; 跌幅超过20%还有奥地利ATX指数和比利时BFX指数,分别下跌21.6%和20.4%; 亚太市场整体跌幅居前,韩国综合指数下跌17.28%,恒生指数下跌14.76%,日经225下跌12.08%; 年内创下史上最长牛市的美股市场,进入9月后出现连续调整,截至27日,标普500下跌6.91%,道指下跌6.39%,纳指下跌4.69%。 (a) The largest decline in the A share market was recorded at a depth of 34.42 per cent and the second highest at a drop of 24.59 per cent; 2018十大牛股无一翻倍,创14年来纪录 "Strong" 2018's stock of cattle has never doubled. It's been a 14-year record. 盘点A股全年行情走势,十大牛股不可或缺。不过,今年A股的十大牛股确实有点“拿不出手”,没有一只涨幅超过100%(剔除2017年12月份以来上市新股)。这是自2005年以来,首次出现的情况。 An inventory of Unit A's movements throughout the year is indispensable for the ten big bulls. But this year's Unit A's ten big bulls did seem a little “no” and none of them increased by more than 100 per cent (the elimination of new shares that have been on the market since December 2017). This is the first time since 2005. 数据显示,卫宁健康全年涨幅为85.84%,位居第一;亚夏汽车涨81.29%位居第二;建新股份涨80.87%位居第三。 According to the data, the year-round health increase was 85.84 per cent, the number one; the number of cars in Asha was 81.29 per cent; and the number of new shares in construction was 80.87 per cent. 十大熊股跌幅均超过80%,分别是*ST保千、*ST富控、神雾环保、金亚科技、乐视网、*ST华信、奥瑞德、坚瑞沃能、顺威股份、*ST龙力。 The ten bear shares fell by more than 80 per cent, from *ST-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St-St. 从个股表现来看,剔除2017年12月份以来上市新股,2018年实现上涨的个股数量仅214只,占比仅6.23%,也就意味着,2018年下跌个股超过了九成。具体来看: In terms of stock performance, excluding new shares listed since December 2017, the number of shares that increased in 2018 was only 214, or 6.23 per cent, which means that the share fell by more than 90 per cent in 2018. 两市成交额创四年新低 数据显示,2018年A股总成交量为81662.96亿股,总成交额为897632.06亿元,创下自2015年以来新低,较2017年环比下降19.78%。 The data show that the total volume of Unit A transactions in 2018 was 81,666,296 million shares, with a total volume of $8,973,206 million, which is a new low since 2015, down 19.78 per cent from the 2017 ring. 值得注意的是,今年沪市成交额罕见地多次跌破千亿,数据显示,年内沪指单日成交额共有12次跌破千亿。如果剔除熔断这一特殊情况,沪市日成交额不足千亿的时光还要追溯到2014年,但在2014年8月30日之后,沪市日成交额再无跌下千亿门槛。也就是说,沪市成交额破千亿创下了近4年新低。 It is worth noting that this year’s single-day transactions fell by hundreds of billions, and data show that 12 times a year a single-day transactions fell by hundreds of billions. If they were to be removed from the special case of smelting, less than 100 billion dollars a day would have to go back to 2014, but after 30 August 2014, more than 100 billion dollars a day would have fallen below the threshold. 外资成A股最大买入力量,全年净买入2942亿 虽然A股今年表现较差,但是外资对A股的喜爱不减。数据显示,2018年北向资金累计净买入2492.18亿元,较2017年增长约47%,创历史纪录。具体来看,只有在2月份和10月份北向资金出现就流出情况,其余月份均是净流入。 The data show a record increase of approximately 47% from 2017, when the sum of $24,92.18 billion was purchased in the north in 2018. More specifically, it was only in February and October that the flow of funds took place northwards, with net inflows remaining for the rest of the month. 南向资金通过港股通净买入671亿元,成为开通以来年度最小净买入金额,也首次被北向资金净买入金额反超,全年呈现“南冷北热”局面。整体来看,自互联互通机制开通以来北向资金累计净买入6417亿元。 The net purchase of funds from the south through the Hong Kong shares is 67.1 billion yuan, the smallest net annual buy-in since the start of the operation, and for the first time, the net buy-in from the north was reversed, with a year-long “South Cold North Hot.” Overall, the net buy-in from the north has been 641.7 billion yuan since the introduction of the connectivity mechanism. 资本严冬:股市暴跌、币圈崩盘、投资者亏成狗,2018年值得吗? Capital Winter: Is it worth it in 2018? 回顾2018年的资产价格表现可以用“惨淡”来形容,无论是欧美市场还是新兴市场股市开启溃败模式,全球格局不确定性增多,年初券商机构的预测纷纷打脸。全球股市开启了比惨模式,原油期货也跌得刹不住车,即便是楼市这一中国最好的资产避难所,也迎来了大幅降温。而疯狂的特币已然崩盘,基民成“饥民”…… Looking back at asset price performance in 2018, which can be described as “deeply” – both in the European and American markets and emerging market stock markets – the global pattern has become more uncertain, and the forecast by the bond agencies has increased at the beginning of the year. The global stock market has opened a more tragic pattern, and the future of crude oil has stagnated. 据统计,2018年前11个月全球有89%的资产负收益,为1901年有统计以来的历史之最,秒杀1929年大萧条时期。无论是专业机构还是普通投资者,无一幸免。刚刚过去的寒冬席卷全球,亲爱的投资者,您手中的资产收益如何?投资风格变化是否很大?是否看多2019年的行情? According to statistics, 89% of the world’s negative asset earnings in the first 11 months of 2018, the largest ever recorded in 1901, killed the Great Depression of 1929 in seconds. Neither professional nor ordinary investors were spared. 来源:券商中国 Source: Bonders, China (编辑:黄良东) (Edit: Huang Liangdong)

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论