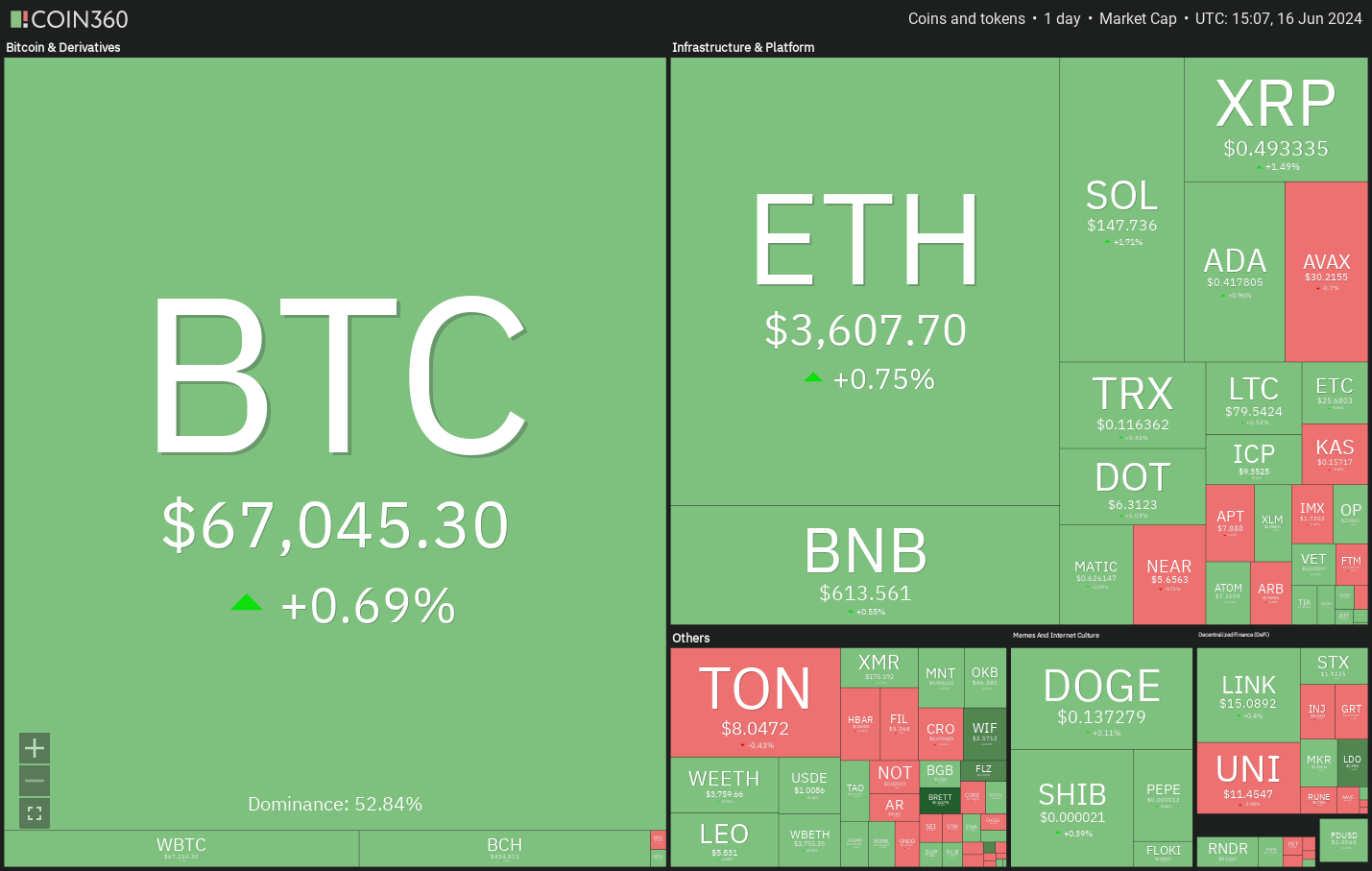

比特币本周下跌超过 4%,表明空头在 70,000 美元附近活跃。然而,比特币投资者似乎将下跌视为买入机会。市场情报公司 Santiment 在 X 上的一篇文章中表示,比特币跌至 66,600 美元时,买盘激增,而卖盘兴趣仍然低迷。

bitcoin fell by more than 4% this week, indicating that the empty head was active near $70,000. However, bitcoin investors seem to see it as an opportunity to buy.

尽管比特币正在努力寻找短期底部,但以太坊正在试图从 6 月 14 日跌破 3,400 美元的近期跌幅中反弹。较低水平的强劲需求可能是由于预期推出现货以太币交易所交易基金 (ETF)。彭博 ETF 分析师 Eric Balchunas预计以太币 ETF最早将于 7 月 2 日开始交易。

Although bit is trying to find the short-term bottom, is trying to rebound from the recent fall of $3,400 in June 14.

比特币近期的疲软增加了几种山寨币的抛售压力,这些山寨币已跌至其直接支撑位附近或下方。然而,如果比特币成功反弹,部分山寨币可能会在较低水平上出现强劲买盘。

Bitcoin’s recent weakness has increased the selling pressure of several bounties, which have fallen near or below its immediate support position. However, if Bitcoin rebounds successfully, some of the bounties are likely to have a strong buyout at lower levels.

比特币的反弹能否拉动加密货币市场走高?让我们研究一下图表上表现强劲的五种加密货币。

Could Bitcoin’s rebound pull up the crypto-currency market? Let's look at the five encrypted currencies on the chart that are strong.

6 月 14 日,比特币跌破 50 日简单移动平均线(66,147 美元),但多头无法维持较低水平。这表明买家正试图捍卫 50 日简单移动平均线。

On June 14, Bitcoin fell 50 days of a simple moving average (US$ 66,147) but many were unable to maintain a low level. This suggests that buyers are trying to defend 50 days of a simple moving average.

20 日指数移动平均线(67,863 美元)已开始下跌,相对强弱指数 (RSI) 处于负值区域,表明空头占优势。如果 BTC/USDT 对从当前水平或 20 日 EMA 下跌并跌破 50 日 SMA,则表明开始向 60,000 美元进行更深层次的修正。

The day-to-day moving average line (US$ 67,863) has begun to fall, and the relative strength and weakness index (RSI) is in a negative area, indicating an advantage of headage. If

如果买家想要卷土重来,他们必须迅速将价格推高至 20 日均线上方。这将为可能反弹至 72,000 美元铺平道路,而空头可能会再次构成强大挑战。

If buyers want to re-emerge, they must quickly push the price up to the 20-day average. This will pave the way for a possible rebound to $72,000, and the empty head could pose a powerful challenge again.

一段时间以来,该货币对一直在 64,602 美元至 72,000 美元之间波动。买家正试图从 65,000 美元的水平开始反弹,该水平很可能在移动平均线面临抛售。如果买家突破这一障碍,该货币对可能会跃升至 70,000 美元。

For some time, the currency has fluctuated between $64,602 and $72,000. Buyers are trying to rebound from $65,000, which is likely to be sold on the mobile average. If buyers break through this barrier, the currency could jump to $70,000.

与此假设相反,如果价格从移动平均线下跌,则表明市场情绪仍然消极,空头在每次反弹时都会抛售。然后该货币对可能会跌至 64,602 美元。这是一个需要关注的重要水平,因为跌破该水平可能会开始跌至 60,000 美元。

Contrary to this assumption, if prices fall from the moving mean line, they indicate that market sentiment remains negative and that empty head is sold at every rebound. Then the currency may fall to $64,602. This is an important level that requires attention, as it may begin to fall to $60,000.

6 月 14 日,以太币从 50 日均线 (3,415) 大幅反弹,表明较低水平正在吸引买家。

On June 14, the Ether rebounded significantly from the 50-day average (3,415) indicating that lower levels were attracting buyers.

20 日 EMA(3,612 美元)是需要关注的关键水平。如果买家将价格推高至 20 日 EMA 上方,则表明调整可能已经结束。ETH/USDT 对随后将试图上涨至 3,730 美元,随后上涨至 3,977 美元。

20 EMA (US$ 3,612) is a key level of concern. If the buyer pushes the price up to 20 days EMA, the adjustment may be over. /USDT will then attempt to rise to US$3,730 and then US$3,977.

如果价格从 20 日均线下跌并跌破 50 日均线,这种乐观观点将在短期内失效。这可能导致价格跌至关键支撑位 2,850 美元。

If prices fall from the 20-day average and fall into the 50-day average, this optimism will lapse in the short term. This could lead to prices falling to a critical support position of US$ 2,850.

该货币对已升至 50-SMA 上方,表明抛售压力正在减轻。如果多头将价格维持在 50-SMA 上方,则表明强劲复苏的开始。该货币对可能升至 3,730 美元,预计该价位将成为阻力位。如果价格从上方阻力位回落但从 20-EMA 反弹,则突破 3,730 美元的可能性将增加。然后该货币对可能反弹至 3,887 美元。

The currency has risen to over 50-SMA, indicating that the selling pressure is decreasing. If prices are kept above 50-SMA, it indicates the beginning of a strong recovery. The currency may rise to $3,730, which is expected to be a drag. If prices fall from the upper resistance but rebound from 20-EMA, the likelihood of a breakthrough of $3,730 will increase. Then the currency will rebound to $3,887.

相反,如果价格下跌并跌至 3,362 美元以下,则表明空头积极抛售反弹。 ETH 价格可能跌至 3,000 美元。

On the contrary, if prices fall and fall below US$ 3,362, the price of ETH may fall to US$ 3,000.

Toncoin (TON)在 6 月 13 日突破 7.67 美元后完成了看涨上升三角形模式。价格从 6 月 15 日的 8.29 美元下跌,重新测试 7.67 美元的突破水平,这很可能见证多头和空头之间的艰苦战斗。

Toncoin (Ton) completed a watch-up triangle after breaking $7.67 on June 13. Prices fell from $8.29 on June 15, retesting the $7.67 breakthrough level, which is likely to witness a tough battle between multiple head and blank.

如果价格从 7.67 美元反弹,则表明多头已将该水平转为支撑位。然后买家将试图将价格推高至 8.29 美元以上。如果他们成功了,TON/USDT 对可能会开始向 10 美元迈进。

If the price rebounds from $7.67, it shows that many of them have shifted to a support position. Buyers will then try to push the price up to over $8.29. If they succeed, TON/USDT may start moving towards $10.

相反,如果价格跌破 7.67 美元,则表明市场拒绝了突破。该货币对可能滑向上升趋势线,这是多头需要捍卫的重要水平。如果价格从上升趋势线回升,多头将再次尝试恢复上升趋势。但如果该水平跌破,抛售可能会加剧,TON 价格可能会跌至 6 美元。

On the contrary, if prices fall by $7.67, the market refuses to make a breakthrough. The currency may slip to the upward trend line, which is an important level that needs to be defended.

价格从 20-EMA 反弹,表明多头继续逢低买入。多头将试图将价格推至上方阻力位 8.29 美元。这一水平可能是一个强大的障碍,但如果多头占上风,该货币对可能会开启下一轮上涨趋势。

Prices rebounded from 20-EMA, indicating that multiple purchases continue to be low. Multiple headlines will try to push prices above the resistance level of $8.29. This level may be a powerful barrier, but if multiple headlines prevail, the currency may turn on the next upward trend.

相反,如果价格下跌并跌破 7.67 美元,则表明多头正在失去控制。该货币对可能跌至 50-SMA,然后跌至上升趋势线,预计买家将介入。

Conversely, if prices fall and fall by $7.67, it suggests that many are losing control. The currency may fall to 50-SMA and then to the upward trend line, with buyers expected to intervene.

UNI币 6 月 12 日,该价格从 50 日移动平均线 (9 美元) 上涨,并于 6 月 15 日触及 12 美元的上方阻力位。

On June 12, the price rose from the 50-day average movement line (US$ 9) and touched the 12-dollar upper resistance position on June 15th.

预计空头将坚决捍卫 12 美元的水平,因为该水平在 5 月 26 日和 6 月 4 日曾是强大的阻力位。然而,20 日均线(10.24 美元)已开始上涨,RSI 处于正区域,表明阻力最小的路径是向上。如果买家将价格推高至 12 美元以上,UNI/USDT 对可能会反弹至 13.34 美元,随后升至 15 美元。

It is expected that the level of $12 will be firmly defended, as it was a powerful resistance position on 26 May and 4 June. However, the 20-day average ($10.24) has begun to rise, and RSI is in a positive region, indicating that the least resistance path is upwards. If buyers push prices above $12, UNI/USDT may rebound to $13.34 and then rise to $15.

如果空头想要阻止上行,他们就必须将价格拉回 20 日 EMA 以下。这可能会使该货币对跌至 50 日 SMA。

If they want to stop going up, they have to pull the price back below 20 days. This may cause the currency to fall to 50 days of SMA.

4 小时图显示,价格一直在上方阻力位附近盘整,表明多头并不急于获利了结,因为他们预计价格将再次上涨。20 日均线呈上坡状,RSI 位于正区域,表明多头占据主导地位。该货币对可能会在 12 美元上方获得动能,并达到 13.34 美元。

4 Hourly maps show that prices have been rounded up near the upper resistance position, indicating that many headlines are not rushing to a profitable conclusion because they expect prices to rise again. 20 The solar average is uphill and RSI is located in the positive region, indicating that multiple headlines dominate. The currency is likely to generate kinetic power over $12, and to reach $13.34.

或者,如果价格从 12 美元下跌并跌破 20-EMA,则表明多头正在急于退出。这可能会将价格拉低至 50-SMA。

Or, if the price falls from $12 and falls into 20-EMA, it means that many are rushing out. This could bring the price down to 50-SMA.

门罗币XMR已经上涨了好几天,但在价格突破 153 美元的阻力位后,买盘加速。

Monroe XMR has been rising for several days, but after the price broke through the 153-dollar resistance slot, buying the plate accelerated.

空头试图在 180 美元处停止上涨,但多头不允许价格跌破 20 日均线 (163 美元)。这表明多头正在小幅下跌时买入,增加了突破 180 美元的可能性。如果发生这种情况,XMR/USDT 对可能会反弹至 190 美元的强劲阻力位。

The empty head tried to stop the increase at $180, but many did not allow the price to fall into the 20-day average ($163). This suggests that many were buying at a small drop, increasing the likelihood of a breakthrough of $180. If this happened, XMR/USDT would have rebounded to a strong resistance position of $190.

如果价格大幅下跌并跌破 20 日均线,这种看涨观点将在短期内被否定。该货币对可能继续下跌,直到在 153 美元找到支撑。

If prices fall sharply and the average of 20 days falls, this view of the increase will be rejected in the short term. The currency may continue to fall until it is supported at $153.

4 小时图显示,该货币对处于下行通道模式内。如果价格从移动平均线上涨,多头将再次试图推动该货币对突破通道。如果他们这样做,反弹至 180 美元以上的前景将有所改善。

4 Hours charts show that the currency is in the lower route mode. If prices rise from the moving mean line, multiple headers will try again to push the currency over the route. If they do so, prospects for rebounding to over $180 will improve.

相反,如果价格跌破移动平均线,则表明多头已经放弃。这可能会将价格拉低至 169 美元,然后跌至支撑线。跌破通道将表明空头已经夺取控制权。

On the contrary, if the price falls down the moving average, it means that many have given up. This could bring the price down to $169 and then fall to the support line. A fall in the route would indicate that a void has taken control.

文章标题:如果比特币价格突破68000美元,ETH、TON、UNI 和XMR可能会上涨

Title of article: If Bitcoin gets over $68,000, ETH, TON, UNI and XMR may get up

文章链接:https://www.btchangqing.cn/658454.html

更新时间:2024年06月17日

Update: 17/06/2024

本站大部分内容均收集于网络,若内容若侵犯到您的权益,请联系我们,我们将第一时间处理。注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论