Author: Grayscale Research

編譯:Felix, PANews

This post is part of our special coverage Egypt Protests 2011.

TLDR :

- 比特幣從2021-2022年的下跌中完全恢復,在2024年3月達到了歷史新高。 Grayscale Research認為,各國央行的急於降息,可能是推動實體黃金和比特幣等價值儲存資產需求增加的因素。

- 以太坊成功實施了一次重大的網路升級,但以太幣在本月的表現遜於比特幣,可能是由於市場認為美國批准現貨ETF的幾率較低。

- 比特幣即將減半(定於4月19日),屆時發行量將減少一半。比特幣網路可預測的貨幣政策與法定貨幣的不確定前景形成對比。

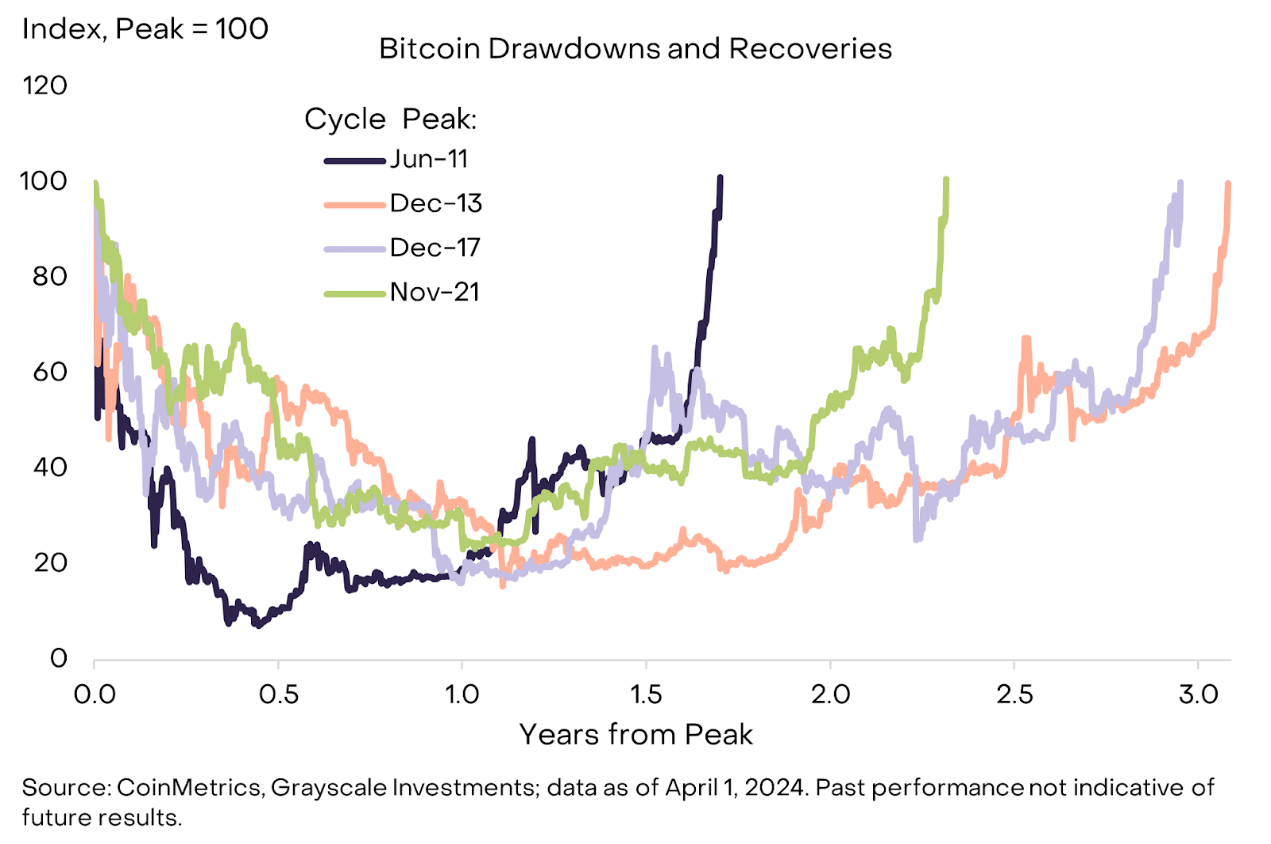

比特幣在大幅下跌後再次強勢反彈。在上輪加密週期中,比特幣在2021年11月達到69,000美元的高峰。然後在接下來的一年裡下跌了大約75%,在2022年11月觸及約16,000美元的低點,然後開始復甦。

During the last round of encryption period, Bitcoins peaked at $69,000 in November 2021. Then fell by about 75% in the following year, reaching a low of about $16,000 in November 2022, and then began to recover.

整體來說,與前兩個週期相比,比特幣恢復速度更快。比特幣只花了兩年多的時間就回到了之前的高峰(圖表1)。相比之下,比特幣從之前的兩次下跌中恢復大約花了三年,而從第一次大幅下跌中恢復大約花了一年半。 Grayscale Research認為,現在正處於另一輪比特幣牛市的“中期”,價格可能會繼續攀升。

Overall, the Bitcoins recovered faster than in the previous two weeks. Bitcoins returned to their previous peaks in just over two years (figure 1); Bitcoins recovered about three years from the previous two drops, and more than a year and a half from the first sharp fall.

圖表1 :與前兩個週期相比,比特幣恢復速度更快

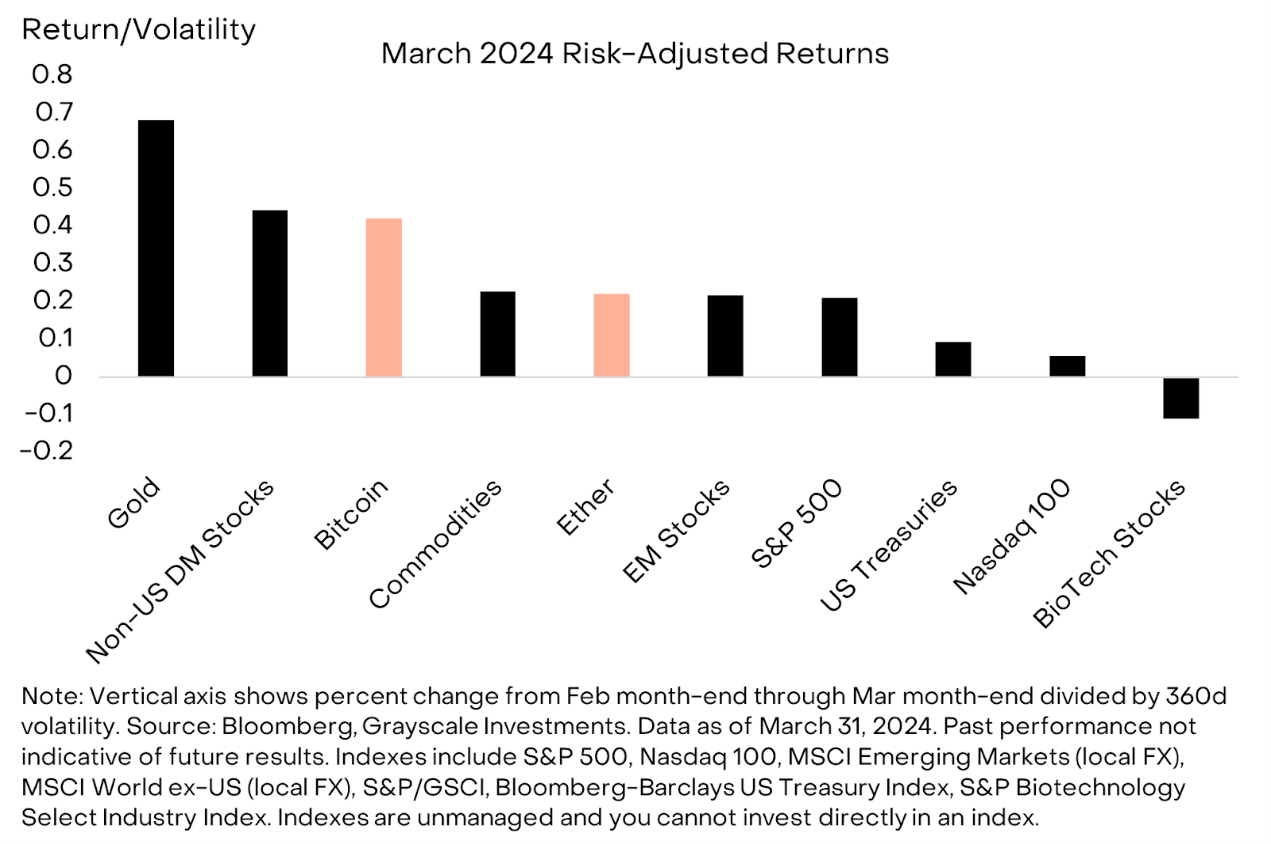

許多傳統資產在2024年3月也實現了正回報。在風險調整後的基礎上(即考慮到每種資產的波動性),比特幣的表現處於區間的高端,而以太幣的回報則接近中間水平(圖表2)。上個月傳統資產市場表現最好的板塊包括實體黃金、非美國已開發市場股票和能源相關股票。與生物技術等新興技術相關的某些股票市場表現遜於大盤。

A number of traditional assets also showed positive returns in March 2024. On the basis of the risk adjustment (i.e. considering the volatility of each asset), the Bitcoin performance is at the upper end of the region, while the Ether returns are close to mid-level (figure 2). The best sections of the traditional property market last month include real gold, non-United States-owned stocks, and energy-related stocks. Some stock markets associated with new technologies such as biotech perform poorly.

圖表2 :比特幣是2024年3月表現最佳的資產之一

chart 2 : Bitcoins is one of the best assets in the month of 2024

上個月各大市場表現強勁的原因之一,可能是各央行發出的降息訊號。根據彭博社調查,除日本央行外,所有G10央行預計將在未來一年降息。上個月的各種事態發展強化了這個前景。例如,在3月19日至20日的會議上,聯準會官員表示,儘管預計GDP成長強勁、通膨上升,但仍計劃今年三度降息。同樣,英國央行自2021年9月以來首次沒有官員支持升息,瑞士央行在3月21日出人意料地降息。

Last month’s developments, for example, reinforced this prospect. At the March 19-20 meeting, the Associated Officials said that despite the expected strong and upswing in GDP, it was still planned to cut three degrees this year. Similarly, the British Central Bank, for the first time since September 2021, did not have official support for raising interest rates, and the Swiss Central Bank dropped unexpectedly on March 21.

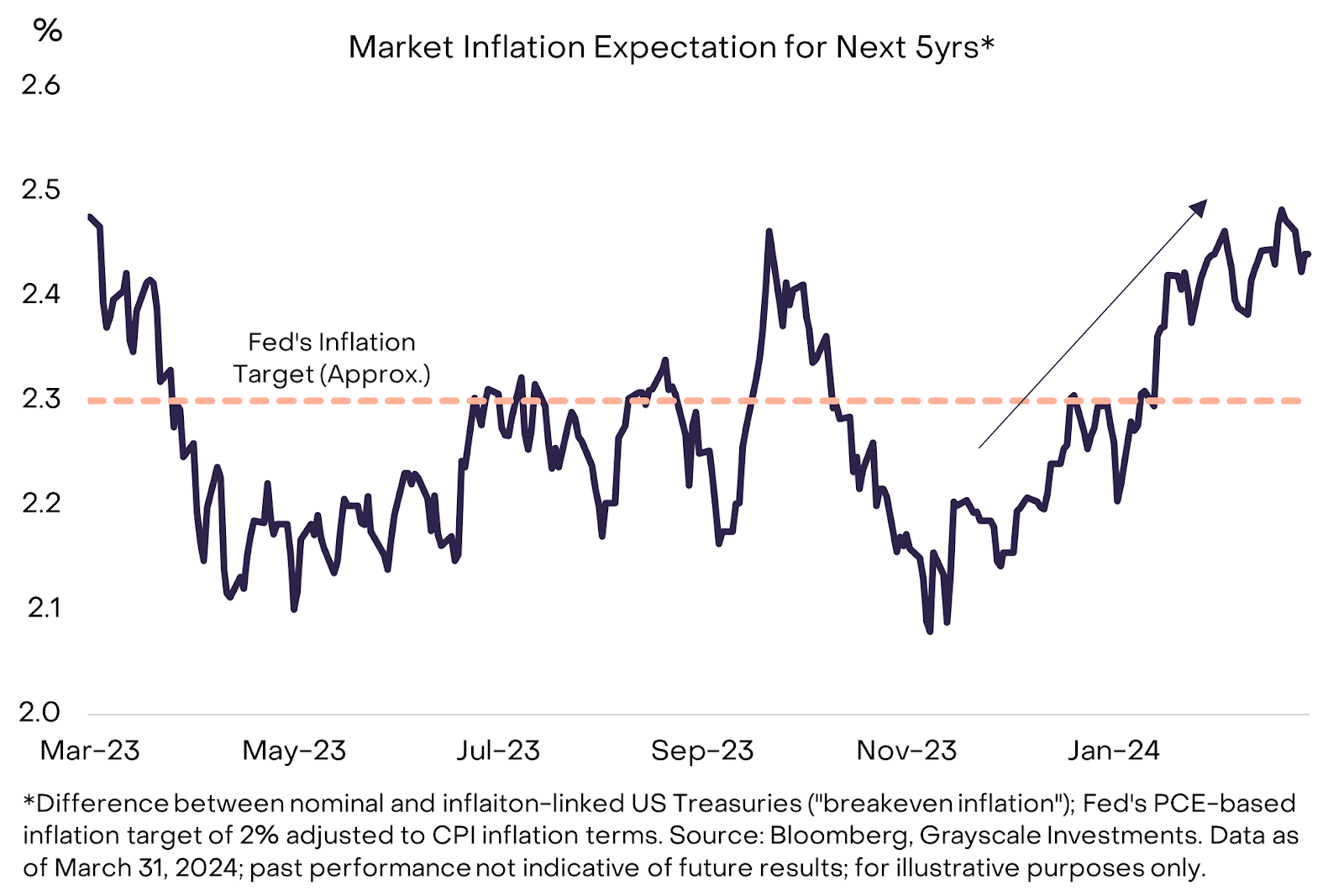

在經濟成長勢頭強勁的背景下,主要國家的中央銀行急於降息,可能導致市場通膨預期上升。例如,名目債券與通膨掛鉤債券的收益率之差——即所謂的“盈虧平衡通膨”,今年在各個期限內都有所增加(圖3)。通膨上升的風險可能反過來刺激對實體黃金和比特幣等其他價值儲存手段的需求。

Against a backdrop of strong economic growth, the central banks of the major countries are eager to lower interest rates, which may lead to an expected rise in market inflation. For example, the difference between the yield ratio of prominent and inflation-linked bonds – the so-called “loss-balance inflation” – has increased over the course of each period this year (figure 3). The risk of rising inflation may in turn stimulate demand for other value saving instruments, such as real gold and bitcoins.

圖表3 :市場通膨預期上升

chart3 : market inflation expected to rise

儘管比特幣創新高,但隨著交易員降低槓桿率以及流入現貨比特幣ETF的資金放緩,比特幣在月中下跌了約13%。從3月整月來看,在美國上市的現貨比特幣ETF的淨流入總額為46億美元,低於2月的60億美元。

Despite its new height, Bitcoins fell by about 13% in the middle of the month as traders lowered their pole rates and slowed their inflows into the current Bitcoin ETF. From March to the end of the month, the net inflows into the US market of Bitcoins ETFs totalled $4.6 billion, down from $6 billion in February.

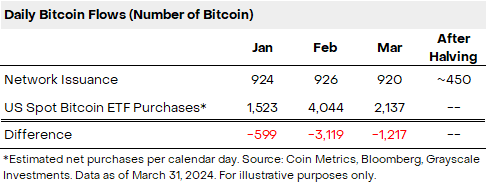

儘管淨流入量比上月下降,但仍遠高於網路發行量。預計美國ETF在3月每個交易日購買了約2,100枚比特幣,而網路每天發行約900枚比特幣(表4)。在4月減半事件之後,網路發行量將降至每天約450枚。

Although clean inflows have declined from last month, they are still far higher than Internet releases. It is estimated that the United States ETF buys about 2,100 bits per trading day in March, while the Internet issues about 900 bits per day (table 4), after a half-time reduction in April, the number of Internet releases will fall to about 450 per day.

圖表4 : ETF流入量持續超過網路發行量

chart4

同時,在3月13日,以太坊網路經歷了重大升級,旨在降低L2成本並促進以太坊向模組化架構的過渡。升級的影響可以在鏈上觀察到:像Arbitrum和Optimism這樣的L2s的交易成本分別從2月份的0.21美元和0.23美元下降到升級後的不到0.01美元,這使得終端用戶在以太坊生態交易成本更便宜。

At the same time, on March 13, the Etherton network experienced a major upgrade to reduce L2 costs and promote the transition of Ether to modular structures. The impact of the upgrade can be seen on the chain: the transaction costs of L2s, such as Arbitrum and Optim, fell from 0.21 and 0.23 dollars in February to less than $0.01 after the upgrade, making end-users cheaper to trade with the euphemism.

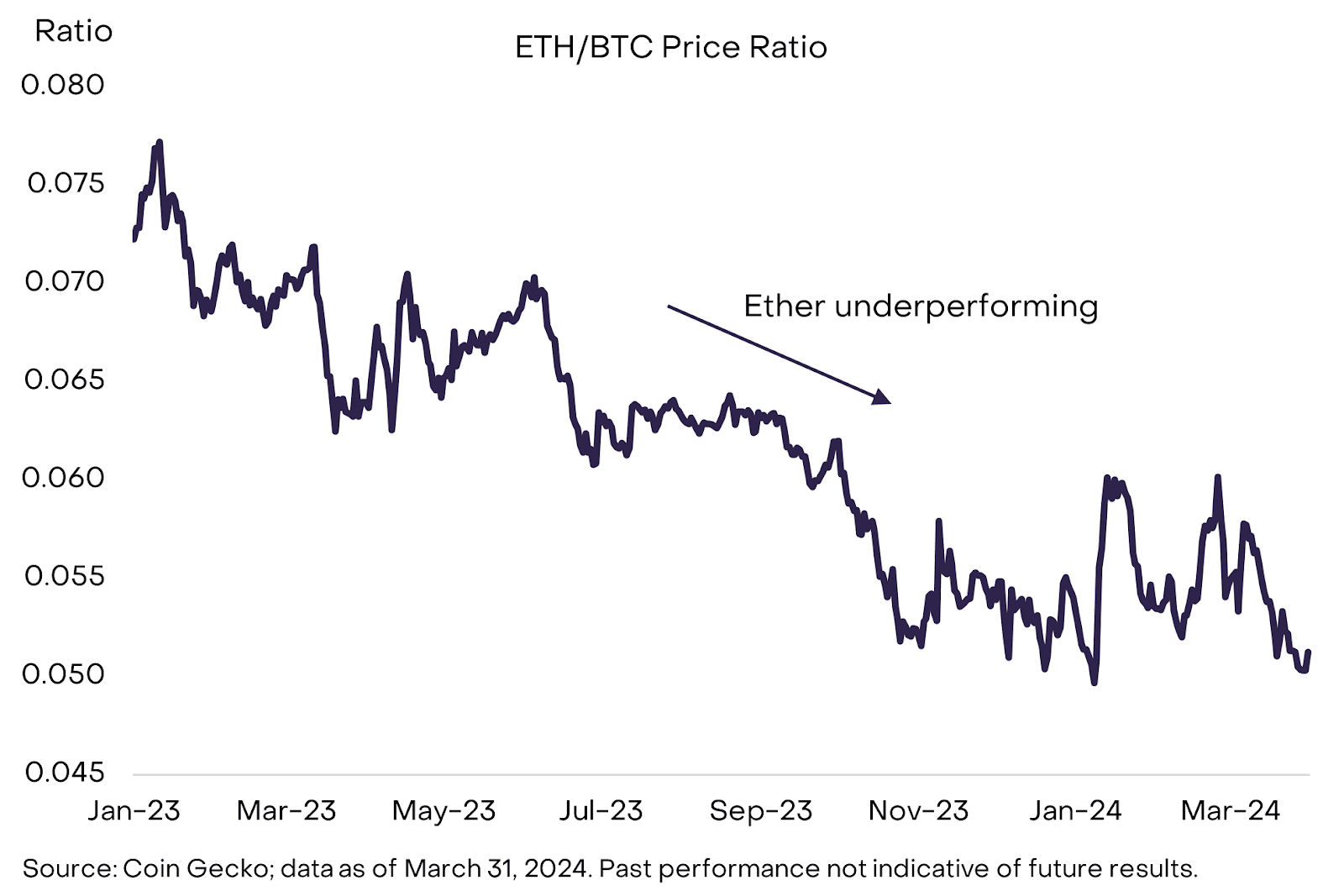

雖然升級降低了交易成本,但以太幣在本月表現落後於比特幣,ETH/BTC的價格比率降至1月初以來的最低水準(表5)。以太幣的估值可能受到以太坊現貨ETF核准的市場預期下降的抑制。根據去中心化預測平台Polymarket的數據,對美國SEC 5月底批准現貨以太坊ETF的共識預期已從1月的80%左右降至21%。預計在目前的申請浪潮中,現貨以太坊ETF能否獲準將成為影響未來兩個月代幣估值的重要因素。

Although the upgrade has reduced transaction costs, the price ratio of the ETH/BTC fell to the lowest level in early January after the month’s performance (table 5). The ETH/BTC valuation may be constrained by the expected decline in the market as approved by the ETF. According to data from the decentralized forecast platform Polymarket, the consensus for US SEC’s approval of the ETF at the end of May fell from about 80% to 21% in January.

圖表5 :儘管進行了重大網路升級,以太幣的表現仍遜於比特幣

graph >5

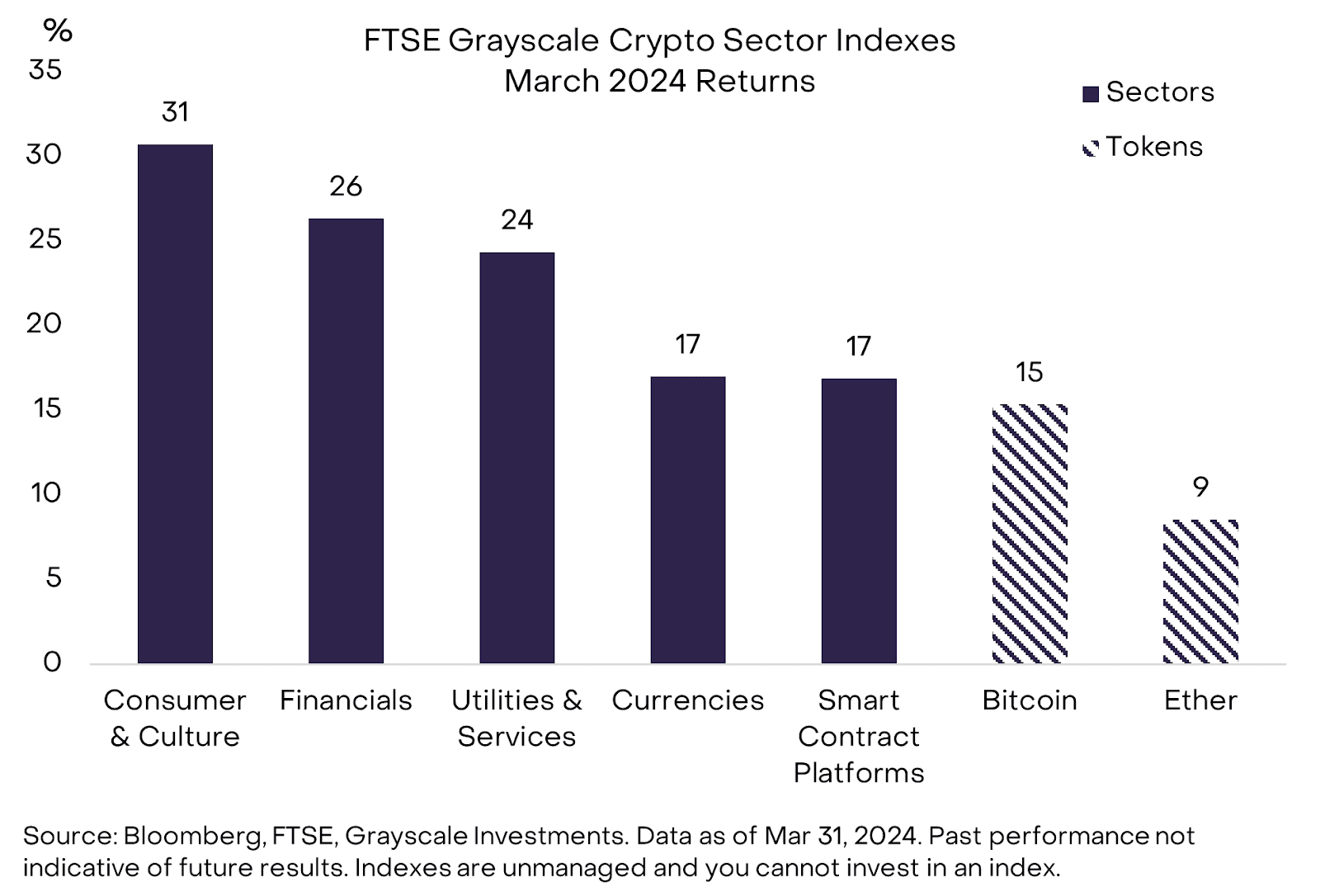

根據Grayscale對加密市場的細分,3月表現最好的細分市場是消費者和文化,歸因於「Memecoins」的高回報(圖6)。 Memecoin是網路文化的體現,在加密領域,與Memecoin相關的代幣主要用途在於娛樂價值;這些項目歷來沒有產生收入,也沒有實際的用例(例如,支付),因此應該被視為風險極高的投資。也就是說,Shiba Inu(按市值計算,消費者和文化領域的第二大Memecoin)背後的開發者試圖透過推出以太坊L2來擴展專案的範圍。

According to Grayscale’s breakdown of the encryption market, the best-performing niche in March was the consumer and culture, thanks to the high return from “Memecoins” (figure 6). Memecoin, a web culture, has been used primarily for entertainment in the encryption domain, where the money associated with Memecoin is used; these entries have no income and no practical examples (e.g., payment) and should be regarded as highly risky investments. That is, the developers behind Shiba Inu (the second largest memecoin in the consumer’s and cultural domain, based on market value).

圖表6 :消費者與文化市場成長超過30%

金融領域的各種代幣在本月也產生了穩定的回報,其中表現最好的是Binance Coin (BNB), MakerDao治理代幣(MKR),THORchain (RUNE), 0x (ZRX)和Ribbon Finance ( RBN)。最近幾個月,幣安在現貨市場交易量中的份額開始恢復(目前為46%),但仍低於2023年2月達到的高峰。

Various currencies in the financial field have also generated steady returns this month, the best of which were Binance Coin (BNB), MakerDao Governance Currency (MKR), Thorchain (RUNE), 0x (ZRX) and Ribbon Finance (RBN). In recent months, the currency’s share in the current market volume has begun to recover (currently 46%), but it is still below its peak in February 2023.

與所有其他資產市場一樣,加密貨幣的估值受基本面和技術因素的影響。從技術角度來看,在美國上市的現貨比特幣ETF的淨流入/流出可能仍是短期內比特幣價格的重要影響因素。這些產品目前約佔比特幣流通量的4%,因此其需求的任何變化都可以對比特幣產生一定的影響。

As in all other asset markets, the valuation of encrypted currency is influenced by fundamentals and technical factors. Technically, the net inflow/outflow of current United States-listed bitcoin ETFs may still be an important factor in short-term Nebit currency prices.

然而,Grayscale Research認為對比特幣的需求最終部分源於投資者對其資產作為「價值儲存」的興趣。比特幣是一種替代性貨幣體系,具有獨特且高度可預測的貨幣政策。美元的供應是由美國財政部和聯準會的人員決定的,而比特幣的供應是由預先存在的代碼決定的:每日發行量每四年下降一半,直到2100萬枚的上限。

However, Grayscale Research believes that the final part of the demand for the bitcoins stems from the investor’s interest in their assets as “value reserves.” Bitcoins are an alternative monetary system with a unique and highly predictable monetary policy. The dollar’s supply is determined by members of the United States Treasury and the Federation, while Bitcoins’ supply is determined by the pre-existing code: it drops by half every four years until the upper limit of 21 million.

在Grayscale Research看來,當投資人對法定貨幣的中期前景不確定時,投資人會尋找具有這種可驗證稀缺性的資產。目前,這種不確定性似乎正在上升:即使通膨仍高於目標,聯準會仍準備好降息;而美國11月的大選可能會刺激宏觀政策的變化,隨著時間的推移,這些變化可能會對美元的價值造成壓力。下個月的比特幣減半事件應該提醒投資者,比特幣的基本屬性是一種稀缺的數位資產,是未來供應不確定的法定貨幣的替代品。

According to Grayscale Research, when investors are uncertain about the medium-term prospects of the statutory currency, investors look for assets with this proven scarcity. At present, this uncertainty seems to be rising: even if inflation is still higher than the target, the association is still ready to cut interest rates; and the November elections in the United States may stimulate changes in macro-optimal policies that, over time, may put pressure on the value of the dollar. The next month’s half-down should remind investors that the basic properties of the currency are a scarce digital asset and an alternative to uncertain statutory currencies for future supply.

相關閱讀:觀點:比特幣四年一輪的牛熊週期或終結

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论