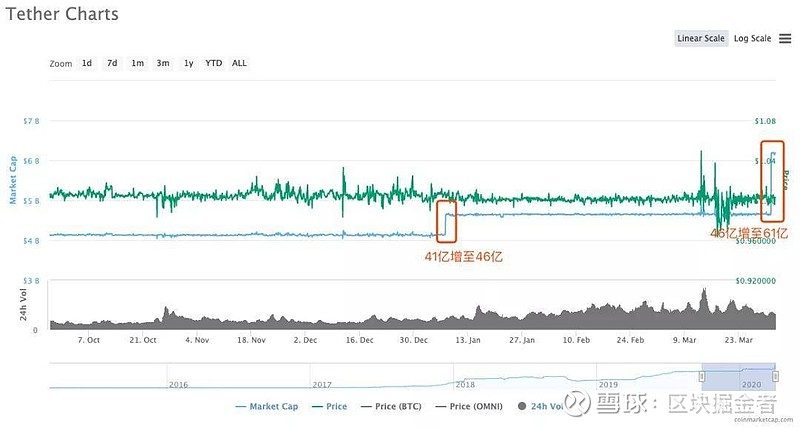

根据Whale Alert数据显示,自3月12日以来,Tether至少对USDT进行了18次增发,平均每天增发1.1次,其中单次增发数量以6000万枚USDT为主。Coinmarketcap的数据也显示,USDT的市值从1月初的41亿美金,增至46亿美金,并在3月份的最后几天,进一步增长至61亿美金。

According to Whale Alert data, since 12 March, Tethe has had at least 18 additional releases of to USDT, an average of 1.1 per day, with a single increase of 60 million USD. Coinmarkcap data also show that the market value of USDDT increased from $4.1 billion at the beginning of January to $4.6 billion and further increased to >b>6.1 billion in the last few days of March.

USDT市值迅猛增长的背后,是Tether无限量的印钞模式的开启。相比于美联储无限QE,来释放美元流动性,缓解股市和经济危机,Tether无限量增发,又是为了什么目的?

Behind the rapid increase in the market value of the USDT is the opening of Tethe's unlimited currency printing mode . Compared to the Fed's unlimited QE, to free up dollar liquidity, ease the stock market and economic crisis, and for what purpose?

我们从USDT发行机制来看,USDT是锚定美元的稳定币,意味着每发行1个USDT,就需要在银行存入1美元或以上的保证金。但在加密货币市场,USDT的市场价格一直处于波动状态,在行情剧烈波动的时候,因为供需关系出现了不同程度的溢价或折价现象。

According to the USDT distribution mechanism, USDT is a stable currency that anchors the dollar , meaning that each USDT issue requires a deposit of one dollar or more in the bank. But in the crypto-currency market, the market prices of the USDT have been volatile, at a time of high volatility, because of varying degrees of premium or discounts in the supply-demand relationship.

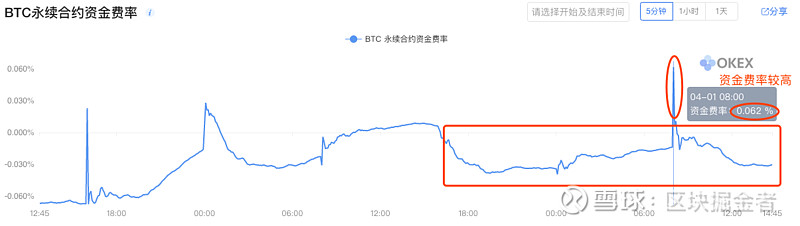

波动尚可解释,但短时间内无限量增发,其背后并没有太多需求层面的因素存在,近期BTC币价崩盘后,市场交易氛围明显下降,投资者参与的积极性大为降低,此种情况下,人为的增加USDT的流动性,除了收割市场外,找不到更多理由。

Volatile fluctuations can be explained, but there are not many demand-side factors behind that increase indefinitely in a short period of time. Following the recent collapse of the BTC currency, the market trading climate has noticeably declined and investor participation has been significantly reduced. In such cases, 's artificial increase in the liquidity of the USDT cannot be justified beyond the harvest market.

另外,无限量增发USDT,是否有足够的美元资产作保证金,也是个大问题。需要知道的是,从2018年开始,Tether就像开始陷入“市场操纵”风波之中,Tether在19年更换了关于储备金的描述,每一枚USDT并没有100%美元现金做保证。后续在纽约州总检察长办公室一举将Tether以及Bitfinex告上了法庭后,Tether也承认并没有100%的美元资金储备,来保证USDT兑付的正常运行。

In addition, it is a big question whether there are sufficient dollar assets to provide security. It is important to know that since 2018, Tether has been caught up in a “market manipulation” wave, and in 19 has changed the description of reserves, and each USDT has not had a 100% cash guarantee. Following the prosecution of Tether and Bitfinex by the New York State Attorney General's Office, Tethe also admitted that there was no 100% reserve of the dollar to ensure that the USDT was working properly.

因为历史原因,作为现实法币和加密资产之间流通的中介USDT获得了快速发展,并成为了目前稳定币市场的老大,并且在市场陷入下跌时,被投资者当做避险来使用。但USDT引起的信任危机,将成为加密货币市场潜在的最大的雷,一旦爆发,其对市场的冲击性和损失无法限量。

For historical reasons, the USDT, the intermediary in the movement of de facto French currency and encrypted assets, has developed rapidly and has become the leader of the current stable currency market and has been used by investors as a flight risk when the market falls. But the crisis of trust caused by USDT will be the biggest potential mine in the encrypted currency market, and its impact and loss on the market will be unlimited if it erupts.

此次无限量的增发USDT,虽然短时并没有引起市场太多的热度,但这本身也说明币圈市场目前的窘境,投资者交易的活跃性已经降至了冰点,现实很严峻。此时Tether靠疯狂印发USDT开启抢劫模式,无疑会让暴雷的几率大为提前。

This limitless increase in USDT, while not causing too much heat in the market at short notice, is in itself an indication of the current dilemma in the currency market, where investor activity has fallen to an ice point, and the reality is dire. At this point, Tether’s frenzied publication of USDT to open up a pattern of robbery will undoubtedly pre-empt thunderstorms.

因市场原因形成的东西,也需要靠市场来进行调节。去年因为Facebook推出了Libra白皮书,引发了全世界的关注和探讨,央行数字货币在这一时期被加速推了出来。央行数字货币一旦落地应用,首先冲击的便是Tether的USDT,不仅是市场份额的冲击,还有USDT面临的强监管的冲击风险,届时将是USDT的生死时刻。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论