币圈利益链,怎一个乱字了得!触目惊心的暴利之下,是联合割韭菜

What's wrong with the strong's chain of interest?

券商中国 王君晖

China & nbsp; Wang Junjing

图片来源:花瓣美素

图片来源:花瓣美素币圈利益链,怎一个乱字了得!

2月1日,成交额稳居全球前三的数字货币交易平台币安发布公告称,根据中国相关政策法规,币安将不为中国大陆地区用户提供服务。此前,已有IOST、UIP、KuCoin等多家机构宣布暂停为中国用户服务。

On 1 February,  图片来源:非小号网站

图片来源:非小号网站

其次,项目要在平台上线需要一定费用,这部分费用弹性空间较大。一位资深投资者告诉券商中国记者,如果是特別火爆的项目,各平台会抢着上,基本不收费;如果是一般性项目,收100—500万不等,或者token总量的1-5%;如果是自家一个生态圈的就象征性收一些。

Second, the project costs a certain amount of money to be connected to the platform, which is more cost-elastic. A senior investor told Chinese journalists that, in the case of a particularly hot project, the platforms would be seized, with little charge; in the case of a general project, between 1 million and 5 million dollars, or 1 to 5 per cent of the total token; and in the case of a community of their own, it would be symbolic.

此外,也有业内人士告诉记者,上币费高的需要100比特币(目前价值700万人民币左右);券商中国记者在采访某项目创始人时被告知,目前项目的代币在某交易平台上线要1000万人民币。

In addition, insiders have told journalists that the need for high currency costs is 100 /spanspanid=quate_BTSTAMP/span (currently worth 7 million );

对此,上述投资者认为,收1000万的绝对是传销项目或者垃圾项目,要进行抵制。

In this regard, the above-mentioned investors believe that 10 million dollars is absolutely a distribution or garbage project to be boycotted.

项目代币上线交易平台,相当于新股公开发行。但由于目前的区块链项目缺乏监管,上不上交易所的唯一标准是交易所和项目方的谈判,如果项目上线知名交易所,可获得潜在背书,并提高成交量。其中的操作空间有多大可以想象。

Because of the current lack of regulation of block chain projects, the only criterion for not going to an exchange is negotiation between the exchange and the project party, with potential endorsements and a higher volume of transactions if a well-known online exchange is available. How much of the operating space is there?

尽管各个平台在公开声明中均表示上线项目都经过了严格审核,一个显而易见的事实是,众多口碑极差的项目如波场等也登陆了包括币安、火币在内的知名交易平台,且交易平台的上币速度在大大加快。

Although various platforms have stated in public statements that online projects have been subject to rigorous scrutiny, it is clear that a large number of low-profile projects, such as wave sites, have also landed on well-known trading platforms, including currency security, and currency coins, and that the pace of the upper currency of the trading platforms has increased considerably.

除了交易手续费和代币上线费的常规盈利方式, “平台币”这一新玩法也是当前的热点,尽管平台“创新”出种种名义,但无法摆脱“变相ICO”的质疑。

In addition to the conventional profit-making methods of transaction fees and billing fees, the new game of “platform coins” is also the current hotspot, and despite the platform’s “innovation” in all its names, it is impossible to escape the challenge of “disguised ICO”.

1月20日,火币宣布将推出“火币全球通用积分”,(Huobi Token简称“HT”),是基于区块链发行和管理的积分系统,可在多场景下使用并流通。HT总量5亿枚,承诺永不增发,只送不卖,每个季度火币Pro将利润的20%用于流通市场回购。

On January 20, the tender announced the launch of the “Global Common Score for the Fire” (Huobi Token short term “HT”), which is a system based on block chain issuance and management that can be used and circulated in multiple settings. The sum of HT 500 million promised never to be increased, only to be sold, and the quarterly tender Pro spends 20 per cent of its profits on repurchases in the circulation market.

火币在官方公告和宣传中均将HT定义为“不私募,不是ICO,只送不卖”的积分,但 “只送不卖”不是对用户的无偿赠送,而是要通过购买手续费预存点卡套餐获赠。根据公告,平台将开放HT/USDT、HT/BTC和HT/ETH的交易对,这意味着,HT与其他数字货币一样,可以在交易平台上交易和流通。

Fire money defines HT in official announcements and propaganda as “no private collection, not ICO, only non-sale” credits, but “no-sale” is not a free gift to users, but rather a gift through the purchase of a pre-positioned card set. According to the announcement, the platform will open trades between HT/USDT, HT/BTC, and HT/ETH, which means that HT, like other digital currencies, can be traded and circulated on trading platforms.

发行类似平台币的,火币并不是第一家。

issues like platform money, which is not the first.

2017年7月14日,数字资产交易平台币安上线。上线前,币安发布了白皮书进行ICO募币。据白皮书介绍,币安平台推行的代币为BNC,总量恒定2亿个,通过ICO发行数量为1亿枚。兑换规则为1ETH兑换2700BNC,1BTC兑换20000BNC。BNC于7月15日上线交易。

On 14 July 2017, the currency of the digital asset trading platform was placed on the line. Before going online, the currency board issued a white paper to collect the currency of the ICO. According to the white paper, the currency platform has 200 million coins, a constant total of 100 million coins, distributed through the ICO. The exchange rules are 1 ETH for 2700 BNC, and 1 BTC for 20,000 BNC. The BNC was traded online on 15 July.

BNC的ICO于6月24日启动,按当时ETH和BTC的价格计算,目前,BNC的价格已是ICO价格的100多倍。

BNC's ICO was launched on 24 June and is now more than 100 times the price of the ICO, at the prices of ETH and BTC at that time.

有业内分析人士认为,平台推出自己的代币或积分,主要目的并非赚钱,而是吸引和留住用户,构建平台自己的社区和生态。

In-house analysts argue that the main purpose of the platform's introduction of its own tokens or credits is not to make money, but to attract and retain users to build the platform's own community and ecology.

平台疑似监守自盗,与监管打擦边球

platform suspected of self-inflicted theft and swipe ball with supervision

目前,交易平台在数字货币世界中的作用极为重要。颇为吊诡的是,在区块链“去中心化”的世界中,交易平台却扮演着一个“中心化”的角色,曾发生过的交易平台被盗事件,不仅使用户遭受严重损失,还会引发数字货币价格暴跌,此外,交易平台因为业务极不透明,往往会参与内幕交易,联合坐庄等操纵市场行为,其中的风险不容忽视。

At present, the role of trading platforms in the digital-currency world is extremely important. It is paradoxical that, in a “decentralized” world of block chains, trading platforms play a “centralized” role, and that the theft of trading platforms that have occurred has not only caused severe losses to users, but has also triggered a sharp fall in digital-currency prices. Moreover, trading platforms, because of their highly opaque operations, tend to be involved in insider trading, and the risks of joint-branding and other market manipulations cannot be ignored.

1月28日,日本数字货币交易平台Coincheck上 5 亿枚 NEM 币遭黑客窃取,价值约5.33 亿美元,受影响的用户数量为 26 万人,是继2014 年 Mt.Gox 事件后,史上规模最大的虚拟货币被窃案之一,随后 Coincheck暂停平台上除比特币之外的加密货币取款。

On 28 January, 500 million NEM coins on Japan's Digital Currency Exchange Platform Coincheck were stolen by hackers valued at some $533 million and affected 260,000 users, one of the largest virtual currencies ever stolen following the 2014 Mt.Gox incident, and then Coincheck suspended encoded currency withdrawals on the platform other than Bitcoin.

有业内人士向券商中国记者表示,某知名交易平台监守自盗众所周知,一方面通过在二级市场操纵价格获利,另一方面通过操纵杠杆交易获利,该平台可提供高达10倍的杠杆,而数字货币本身波动就极大,每日涨跌幅在20%左右很常见,而在币价波动时,该平台振幅明显大大高于其他平台,如此一来,用户极易爆仓,平台则可在杠杆交易中获得更丰厚的回报。关于这一说法,记者在多方求证中均获得肯定的回复,且矛头均指向同一家交易平台。

Some insiders have told Chinese journalists that it is well known that a well-known trading platform can provide up to 10 times the leverage by manipulating prices in secondary markets on the one hand, and leverage transactions on the other, and that the digital currency itself is highly volatile, with increases and declines of around 20 per cent per day, and that the platform is significantly higher than other platforms in the case of currency price fluctuations, so that users are extremely vulnerable and the platform can get a greater return on leverage. In this case, journalists have received a positive response from multiple sources and have pointed to the same trading platform.

在2017年9月出台的相关监管政策中,国内的交易平台被禁止提供法币与数字货币的充提业务,数字货币交易经历了短暂的萧条期。为继续相关交易业务,各平台在海外布局及规避监管方面做出了很多设计,一方面,通过场外交易、币币交易等更曲折和隐蔽的方式提供数字货币交易服务;另一方面,将注册地放至海外,规避国内政策风险。

In the relevant regulatory policy introduced in September 2017, domestic trading platforms were prohibited from offering French and digital currency supplements, and digital currency transactions went through a short period of depression. In order to continue the related transactions, platforms have developed a number of designs for overseas placement and for circumvention of regulation, on the one hand by providing digital money trading services in a more volatile and covert manner, such as off-site transactions, currency transactions, etc., and, on the other hand, by placing their registration abroad to avoid domestic policy risks.

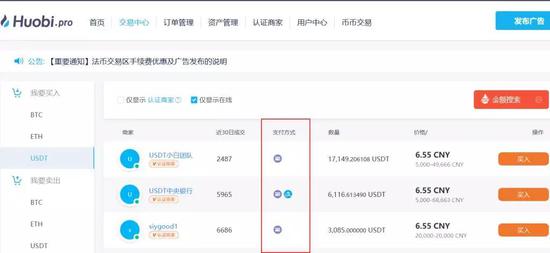

在解决法币与各个数字货币的兑换交易方面,各个平台通过USDT代币连接场外交易和币币交易。即先通过场外交易将法币兑换为USDT,再通过USDT与各种数字货币的兑换。

In order to resolve the exchange of French currency with various digital currencies, the platforms link foreign and currency transactions through USDT tokens.

图片来源:huobi.pro

图片来源:huobi.pro仅从这一过程来看,其中变隐藏着不少风险。首先,在场外交易中,交易双方通常是通过支付宝、微信、银行卡转账等方式直接进行资金往来,安全性无法保证。

From this process alone, many risks are hidden. First, in off-site transactions, the two parties to the transaction usually carry out direct transactions through payment of treasures, micro-mails, bank card transfers, etc., without security guarantees.

其次,关于USDT,有投资人对券商中国记者表示,可能是一颗定时炸弹,一旦引爆,会引发数字货币市场的系统性风险。

Second, with regard to the USDT, investors to Chinese journalists who had issued coupons indicated that it could be a time bomb, which, if detonated, could create systemic risks in the digital currency market.

USDT由Tether公司发行,宣称将严格遵守 1:1 的准备金保证,即每发行 1 枚 USDT 代币,其银行帐户都会有 1 美元的资金保障。同时,该公司明确表示了可能的风险:“Tether 是去中心化数字货币,但是我们并不是一家完美去中心化的公司,我们作为中心化的质押方存储所有的资产。所以公司可能破产;公司开设账户的银行可能破产;银行可能冻结资金;公司可能卷款落跑;重新中心化风险可能让整个系统瘫痪

The USDT, which was issued by Tether, announced that it would strictly adhere to the 1:1 reserve guarantee, that is, that for every dollar of USDT issued, its bank account would have a $1 guarantee. At the same time, the company made clear the possible risk: “Teth is decentralized digital currency, but we are not a fully decentralized company, and we store all the assets as a centralized pledge. So the company may be bankrupt; the bank that opened the account may be bankrupt; the bank may freeze the funds; the company may roll the money; and the risk of re-centrification could paralyse the entire system.

此外,据券商中国记者了解,除了公开的风险外,USDT还可能存在其它风险:

一是其银行账户是否有足够兑付金是不会公开给用户的,即用户没有合法途径查询到Tether的银行账户是否真的有其发行USDT数量这么多的美元; The first is whether the bank account has sufficient cash to be made public to the user, i.e. the user does not have legal access to Tether's bank account to find out whether there are in fact United States dollars issued in the amount of USDT; 二是Tether并未承诺保证兑付,在其免责条款中,也提到免除在任何条件下(包括公司倒闭清算时)兑付法币的责任; Second, Tether did not undertake to guarantee payment and, in its exemption clause, also referred to exemption from liability for payment of French currency under any conditions, including when the company was liquidated; 三是USDT发行量由哪些因素调节控制并未公开,其在设计之初的销毁机制是否真的使用过也并不清楚。 Third, the factors by which the distribution of USDT is regulated and controlled are not publicly available, and it is not clear whether the destruction mechanism was actually used at the beginning of the design. 责任编辑:张伟

发表评论