作者| Peter

The author, Peter.

寫在前面:Web3CN 自成立以來,已累積發布1000+ 篇原創文章,調查300+個優質的區塊鏈項目,我們重點關注公鏈、ZK、Layer2 等底層基礎設施項目,以及最具爆發潛力的DeFi,NFTFi以及GameFi等應用程式。如果您對以上賽道的投資感興趣,歡迎加入Web3CN核心用戶社群一起交流。微信ID:Web3CN_(Web3CN投研助手),添加時請備註關注賽道,以便助手將您拉進相應賽道的社群,否則小助手可能不會通過您的好友請求哦。

It is written in front: Web3CN, since its inception, has accumulated 1,000+ original articles to investigate 300+ high quality sector chain items, focusing on base-based projects such as public chains, ZK, Layer2 and the most explosive applications such as DeFi, NFTFi, and GameFi. If you are interested in investing in these tracks, you are welcome to join the Web3CN core user community.

談到BTC Layer2,似乎是個陌生且生硬的話題,好像BTC搞Layer2非常政治不正確。其實,大家所熟知的閃電網路就是最知名的BTC Layer2之一。

When it comes to BTC Layer2, it seems to be a strange and hard one, as if BTC was politically incorrect in dealing with Layer2. In fact, one of the most well-known BTC Layer 2 is known as the Lightning Network.

閃電網路的核心目標是拓展比特幣的支付場景,讓BTC突破比特幣區塊鏈低TPS、高GAS的束縛,讓BTC在Lightning Network這個Layer2上便宜且快速地實現BTC支付。

The central goal of the Lightning Network is to expand the Bitcoin payment scene to allow BTC to break through the low TPS and high GAS beams of the Bitcoin chain, and for BTC to make a cheap and quick BTC payment on Lighting Network Layer2.

而今天我們要聊的BEVM則是相容EVM的BTC Layer2,其核心目標是拓展比特幣的智慧合約場景,讓BTC突破比特幣區塊鏈非圖靈完備、不支援智慧合約的束縛,讓BTC可以在BEVM這個Layer2上建構以BTC為原生GAS的去中心化應用。

And the BEVM that we are talking about today is the BTC Layer2, which is compatible with EVM and whose central objective is to expand the wisdom of the Bitcoins, to allow BTC to break through the unintuitive, unsupportive, intellectual chain of the Bitcoins, and to allow BTC to build a center-up of BTC as the original GAS on the BEVM Layer2.

兩者,雖然殊途,但是同歸,都是為了拓展比特幣的應用場景,在增強BTC Layer1的同時,以Layer2拓展比特幣的更多應用場景和可能性。

Both, though not the same way, were seeking to expand the Bitcoin application scene and, at the same time as BTC Layer1, to expand the Bitcoin application scene and possibilities by Layer2.

BEVM的設計概念是:在不改變比特幣原有技術框架的情況下,直接取用比特幣原生技術來實現去中心化的BTC Layer2。具體方式是Musig2聚合多簽技術+比特幣輕節點,實現BTC去中心化跨鏈到BTC Layer2,由於Layer2完全相容於EVM,因此,可以輕鬆地讓BTC實現各類去中心化應用。

The BEVM is designed to use BTC Layer2 directly to achieve centralization without changing the original technical framework of the Bitcoins. The specific approach is that Musig2 amalgamation multi-signature + bitcoins amplifies the BTC to the BTC Layer2, which is fully compatible with the EVM, so that BTC can easily be decentralised.

EVM的設計概念還有一個潛在台詞,這也應該是為廣大加密社群所共識的:一切嘗試在比特幣Layer1上運行複雜智能合約的方向其實是走不通的,且有悖中本聰起初對比特幣的設計理念。因此,應該使用比特幣原生技術把BTC以去中心化且安全的方式跳脫到Layer2,從而讓BTC擺脫比特幣Layer1的框架束縛,以此重煥生機。這也是眾多ETH Layer2之於ETH的設計理念。既然,ETH Layer2獲得了廣泛成功,那麼,BTC Layer2則亦能復現!

The design concept of the EVM also has a potential line, which should be shared by the wider encryption community: all attempts to run a complex intellectual contract on the Bitcoin Layer 1 are actually unwieldy and contrary to Benji’s original design idea of the Bitcoin. Therefore, BTC should be removed from Layer2 in a central and safe manner using Bitcoin biotech, from the framework of the Bitcoin Layer1 to recreate it. This is also the idea that many ETH Layer2s are designed for ETH. Since ETH Layer2 has been widely successful, BTC Layer2 can be restored.

那麼,BEVM是如何實現去中心化BTC Layer2的呢?

要搞清楚這個問題,我們還得從2021年BTC Taproot升級開始。

To figure this out, we have to start with the 2021 BTC Taproot upgrade.

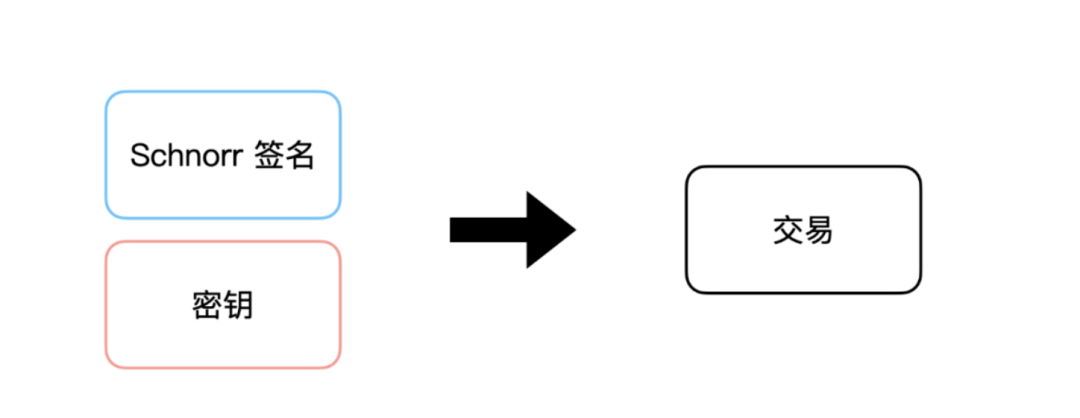

2021年BTC的Taproot升級帶來了Schnorr Signature ,而Schnorr Signature帶來的Musig2聚合簽名技術實現了BTC的去中心多簽,也從此打開了基於BTC去中心化多簽的巨大應用場景。 BTC Layer2就是去中心化多簽最大的應用程式場景之一。

In 2021, BTC’s Taproot upgrade brought with it Schnorr Signature, while Schnorr Signature’s Musig2 Aggregator technology led to the BTC’s oversigning of the centre, and has since opened up a huge multi-signing application scenario based on BTC’s centralization. BTC Layer2 is one of the largest applications to centralize multiple signatures.

Schnorr Signature 是以德國數學家和密碼學家Claus-Peter Schnorr 命名的數位簽章演算法, 2008年中本聰在設計比特幣協議,該演算法尚未開源,因此,中本聰並未使用該簽章演算法,而是選用了當時已經開源的橢圓曲線數位簽章演算法(ECDSA)。

Schnorr Signature is a digital signature algorithm named by the German mathematician and cryptographer Klaus-Peter Schnorr. In mid-2008, Ben was designing the Bitcoin agreement, which is not yet open-sourced, and therefore China did not use the signature algorithm, but chose instead the digital signature algorithm (ECDSA), which was already open at the time.

但是,比特幣核心開發者在將十多年的實踐中卻發現,Schnorr Signature才是比特幣的未來,因為它在密碼學特性上的優勢,可以為比特幣提供更安全、更方便、更具拓展性的服務,其中,最突出的就是可以非常方便和隱蔽的方式構建去中心化多簽交易,這些簽名地址可以達到幾百個甚至上千個,但是,卻絲毫不會影響簽名的速度。因此,Taproot升級後,Schnorr Signature被正式引入了比特幣網絡,從此開啟了比特幣去中心化多簽的新時代。

However, in more than a decade of implementation, the Bitcoins core developers have found that Schnorr Signature is the future of Bitcoins, because of its advantages in cryptography, which can provide them with safer, easier and more outreach services, most notably through the creation, in a very convenient and covert way, of decentralised multiple-signing transactions, which can reach hundreds or even thousands, but which do not affect the speed of signing. Thus, after Taprot was upgraded, Schnorr Signature was officially introduced into the Bitcoins network, which has opened a new era of more signatures than that of centralization.

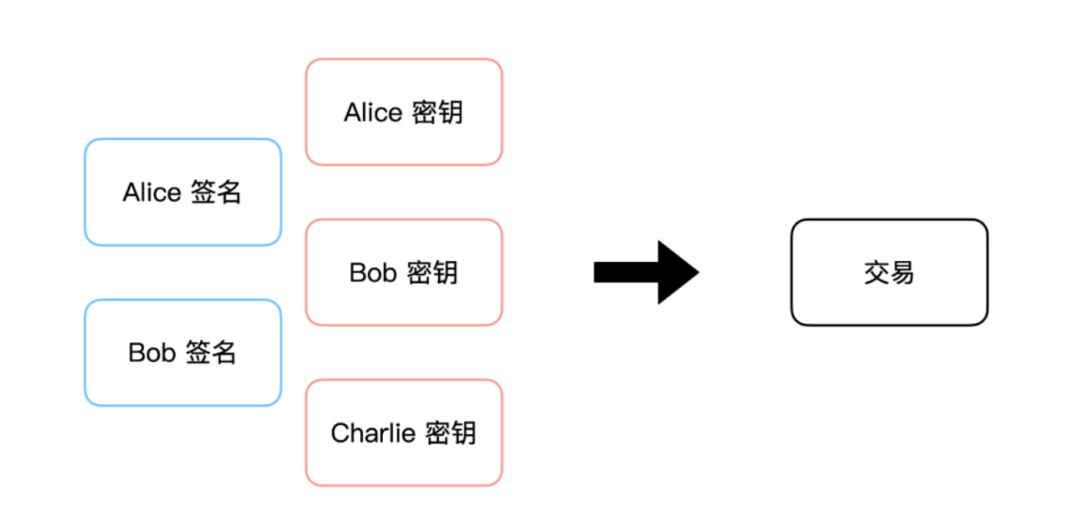

那麼,Schnorr Signature實現的多重簽名和傳統的多重簽章有什麼不同呢?

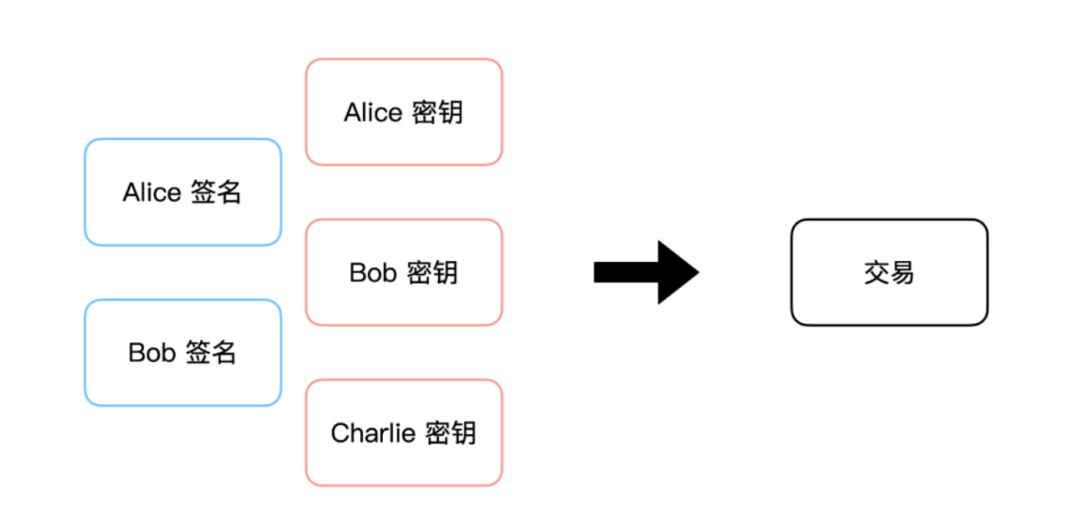

本質上來講,Schnorr Signature所實現的並不是傳統意義上的「多簽」而是一種聚合簽章技術。這裡就得提到Musig2聚合簽章技術,舉例:

In essence, what Schnorr Signature has realized is not "multi-signature" in the traditional sense, but a fusion signature technique. Here is a reference to Musig2 polymer signature technology, for example:

在Musig2的方案中,假設目標是100個比特幣錢包地址來共同管理BTC,也就是建構一個100個地址的多簽,那麼,這100個地址的私鑰將共同產生一個聚合公鑰地址,然後共同為該公鑰創建一個有效簽名,這個聚合公鑰來管理BTC資產(去中心化的比特幣資產管理),當需要轉移資產時,只需要一個聚合公鑰+一個有效簽名就可以轉移資產。大幅降低交易位元組數,因此,可以降低成本、提升速度,同時保障去中心化。

In Musig2, assuming that the goal is to co-manage BTC with 100 bits of a wallet, that is, to construct an oversigning of 100 addresses, the private key of the 100 addresses will co-create a condenser key address and create a valid signature for the key, which will manage the BTC asset (decentralized bitcord asset management) and, when a transfer is required, only a polymer key plus a valid signature will be needed to transfer the asset. As a result, a significant reduction in the number of trading bits could reduce the cost, increase the speed and guarantee centralization at the same time.

?

?

?

?

傳統多簽?

而傳統的多簽方案則是,需要100個錢包地址其中的2/3地址去挨個簽名,這個過程異常複雜,而且會產生巨大的數據,造成區塊擁擠,速度降低,成本增加。理論上,傳統多簽也很少能實現100個地址同時參與多簽,因此,無法實現真正的去中心化BTC資管,類似WBTC採用傳統多簽方案,靠一家公司(BitG)在託管這些BTC ,RenBTC、TBTC雖然採用了分散式多簽,但是,依然無法實現真正的去中心化多簽。傳統多簽和分散式多簽,一般多簽地址設定為5-7,或9-11,超過11個多簽就會大大影響安全和效率。而Musig2聚合多簽卻可以實現幾百個地址甚至上千地址同時管理比特幣,在保障去中心化的同時,還不影響成本和速度。

In contrast, traditional multiple signatures, which require two-thirds of the 100 wallet addresses to be signed by each other, are complicated and cause huge numbers to crowd out, reduce speed, and increase costs. In theory, more traditional signatures rarely make it possible to sign at the same time 100 addresses, thus making it impossible to decentralize the BTC, as in the case of the traditional World Trade Organization (WTO), which uses more than 11 signatures, while one company (BitG) handles BTCs, RenBTCs, TBTCs, and even manage multiple signatures at the same time.

Schnorr Signature

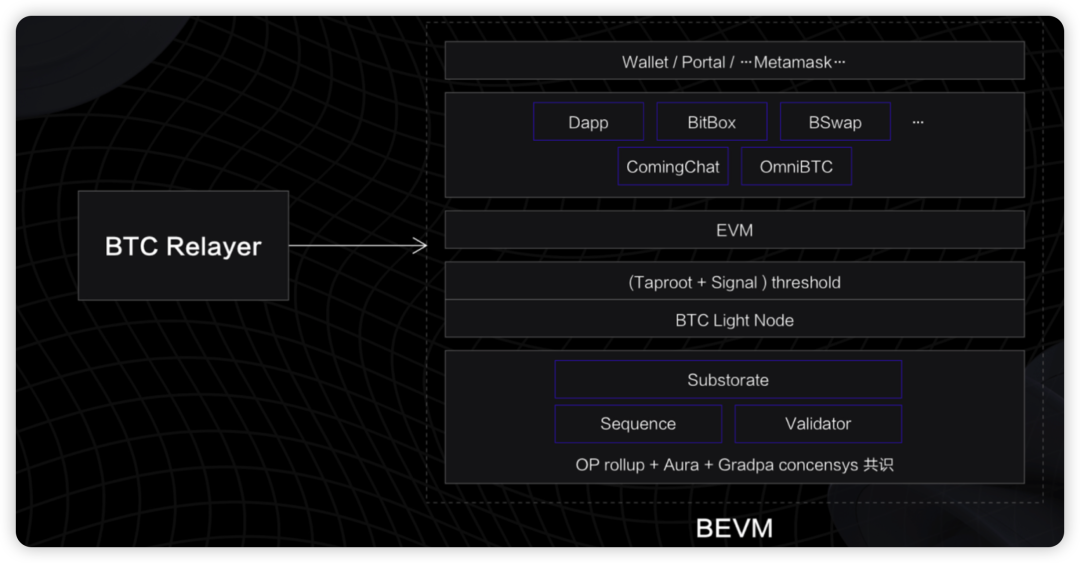

BEVM正式基於Musig2的去中心化多簽讓BTC跨鏈到BTCLayer2,整個過程完全去中心化。同時,BEVM更是引進了非常成熟的SIgnal隱私網絡,當共同公鑰需要參與轉帳時,參與多簽的地址直接在SIgnal網路進行快速的隱私簽名,最後,把最終交易上傳到比特幣區塊鏈。

The BEVM is officially based on Musig2 decentralisation, which allows BTC to cross-link to BTCLayer2 and completely decentralizes the entire process. In the meantime, BEVM leads to a very mature SIGnal private network, and when common keys need to be involved in the transfer, the multiple-signing address is sent directly to SIGNAL for rapid private signature and, finally, to upload the final transaction to the Bitco currency chain.

那麼,BEVM (Layer2)和BTC區塊鏈(Layer1)又是如何即時通訊的呢?

上文,我們講到,BEVM使用Musig2技術,讓BTC可以去中心化的方式跨到Layer2上,同時,BEVM還創造性地把參與聚合多簽的地址和維護Layer2網絡的節點進行一一錨定,即;維護Layer2網路的節點也共同參與BTC資產的管理,這樣進一步保障Layer2的安全。而且,為了保障Layer1和Layer2的通訊,這些參與節點都是BTC輕節點,BTC輕節點可以讀取BTC鏈上的即時動態,可以保障L1和L2的即時通訊。

As noted above, BEVM uses Musig2 technology, allowing BTC to go down to Layer2 in a central way. In the meantime, BEVM has creatively fixed the number of nodes that participate in the multiple signings of the polymer and maintain the Layer2 network, i.e., the nodes that maintain the Layer2 network are also involved in the management of BTC assets, thereby further safeguarding the safety of Layer2. Moreover, in order to guarantee the communication of Layer1 and Layer2, these participation nodes are BTC light spots, BTC light spots that can read the current dynamics of the BTC link and can guarantee the immediate communication of L1 and L2.

BEVM的BTC layer2技術架構圖由於BEVM是相容EVM的Layer2,在ETH EVM上可以部署的DeFi、GameFi、SocialFi、NFTFi等一切去中心化應用,都可以在BEVM上部署,唯一不同的是,ETH Layer2以ETH為GAS,BTC Layer2以BTC為Gas。而BTC Layer2上的每一筆交易,都將按照10:1的比例以定序器打包到BTC Layer1,從而讓BTC Layer2共享BTC Layer1的安全性。

The BTC player 2 technical architecture of BEVM is based on the fact that the BEVM is an EVM-compatible Layer2, and all deFi, GameFi, SocialFi, NFTFi, etc. that can be deployed on ETHEVM can be deployed on BEVM, except that EH Layer2 uses ETH as GAS and BTC Layer2 as BTC as Gas. Each transaction on BTC Layer2 will be packaged to BTC Layer1 by a sequencer at a scale of 10:1 to allow BTC Layer2 to share BTC Layer1 security.

BEVM的正統性如何?會獲得BTC社群的廣泛支持嗎?

比特幣社群是非常考慮正統性,正統性足的項目,意味著根正苗紅,意味著將得到比特幣社群的支持和支持,而正統性的考量一般有三個面向:

The Bitcoin community is very open-minded, positive-consistency project, which means that it will be supported and supported by the Bitcoin community, while the positive-consumption considerations are generally three-sided:

1.是否改變比特幣原有架構(除非社群共識後的比特幣升級)

1. Whether or not to change the Bitcoin structure (unless it is upgraded by community consensus)

2.是否共享比特幣區塊鏈的安全性(最終記帳是否存在比特幣最長鏈上)

2. Whether to share the security of the bitcoin chain (the final account is whether there is a bitcoin's longest chain)

3.用戶是否真正掌握私鑰,掌握自己的BTC(不信任何一個第三方,只信任去中心化網路)

3. Whether the user really owns the private key and owns his own BTC.

我們來看BEVM是否滿足這三條。

Let's see if the bevm is satisfied with these three.

1.文章開頭我們就提到,BEVM的設計概念就是遵循比特幣原有框架,不對比特幣網路做任何改變,而且是取用比特幣原生的Musig2簽名來實現比特幣的去中心化跨鏈。

1. At the beginning of the article, we mentioned that the design concept of BEVM was to follow the original Bit currency framework, not to make any changes to the Bit currency network, and to use the original Musig2 signature of Bitcoin to make the Bitcoin decentralised cross-linkage.

2.由於BEVM是比特幣的Layer2,和以太坊的Layer2一樣的原理,BVEM上的每一筆交易都將按照10:1的比例合併打包並透過sequencer(定序器)上傳到比特幣區塊鏈上,因此,BEVM共享比特幣區塊鏈的安全性,只認比特幣最長鏈為唯一安全帳本。

2. Since the BEVM is Layer2 of Bitcoins and the same principle as the Etherkom Layer2, each transaction on BVEM will be packaged at a scale of 10:1 and uploaded over the chain of the Bitcoins through the Sequisr (sequencer), the BEVM shares the security of the Bitcoins chain, recognizing only that the Bitcoins have the longest chain as the only safe account.

3.由於BEVM是採用比特幣原生的Musig2簽章演算法,因此,BEVM可以把這個聚合簽署的節點拓展到上1000個,使用一個靠BTC輕節點維護的去中心化網路來儲存和轉移用戶的BTC資產,這無疑是去中心化的,安全的,也是非常遵循比特幣精神的。 (這也讓BEVM和一些比特幣側鏈項目完全區分開來,側鏈往往靠傳統的跨鏈方案來掛鉤比特幣,但是,本質仍是中心化的)

3. Since the BEVM is based on a bitcoin-born Musig2 signature algorithm, it is possible for BEVM to expand the signature node of this polymer to 1,000, using a seminal decentralized BTC-maintained network to save and transfer the user's BTC assets, which is undoubtedly central, safe, and very closely guided by the bitcoin spirit. (This also separates BEVM from some bitcoins, which often rely on traditional cross-link programmes to match the bitcoins, but the quality is still central.)

因此,透過以上三點,可以看出,BEVM的設計非常符合比特幣社群主張的正統性,也必將獲得比特幣社群的廣泛共識和支持。

Thus, through the above three points, it can be seen that the design of the BEVM is very consistent with the fundamentals of the Bitcoin community and that it will also enjoy broad consensus and support from the Bitcoin community.

目前BEVM先行網路已經上線,開發者可以基於BEVM建構各類應用,由於BEVM完全相容EVM,因此對於熟悉EVM的開發者來說,部署和遷移成本極低。

Currently, the BEVM frontline network is already online, and developers can construct applications based on BEVM, and because it is fully compatible with EVM, deployment and migration costs are extremely low for those familiar with EVM.

目前BVEM上已經有支援BRC20資產交易的DEX,用戶可以存入BTC+BRC20資產,成為LP,進而享有DEX交易帶來手續費。目前我們可以從官方網站看到,BEVM上部署的BTC DEX-Bswap,目前最大的Pool是btc/sats,用戶可以存入資產成為LP,享受DEX交易手續費。

Currently, BVEM has an EX that supports BRC20 asset transactions, which can be deposited into BTC+BRC20, become a LP, and receive transaction costs. Currently, we can see BTC DEX-Bswap, which is deployed on the BEVM website, and the largest Pool is currently btc/sats, which can be put into assets to become LP and receive transaction costs from DEX.

除此之外,BEVM上也運行一個全鏈DEX——omniBTC,支援BTC在包括ETH、ETH主流L2、SUI、Polkadot等十幾條主流鏈上進行交易。

In addition to this, a whole chain of DEX-omniBTC is running on BEVM to support BTC in trading on dozens of main chains including ETH, ETH Main L2, SUI, Polkadot, etc.

BEVM在不改變比特幣原有框架的基礎上,創造性地使用BTC原生的Musig2聚合簽名技術+比特幣輕節點的方式,讓BTC可以構建完全去中心化的Layer2,從而把BTC引入去中心化應用世界。

BEVM, without changing the foundation of the original Bitcoin framework, was creatively using BTC's original Musig2 polymer signature technique + the Bitcoin light node, allowing BTC to construct a completely decentralised Layer2 from which to introduce BTC into the world of decentralisation applications.

從比特幣長期發展來看,發展BTC Layer2將成為比特幣網路長期穩定的必要之選,由於比特幣可挖數量有限,隨著比特幣的產出不斷減半,比特幣區塊鏈僅靠區區塊獎勵將難以長期吸引礦工持續維護網絡,因此,比特幣的應用場景產生的手續費收入將成為最重要的突破口之一,閃電網絡選擇了支付場景,而BEVM選擇了更為廣闊的智能合約場景。

The long-term development of the Bitcoin will make the development of BTC Layer2 one of the most important breakthroughs, given the limited number of bitcoins that can be dug up, the fact that the Bitcoin chain will be halved with the production of bitcoins, and the fact that the Bitcoin chain is merely a block incentive that will not attract miners for a long-term period of time to sustain the network. Thus, the revenue generated by the Bitcoin appliance will be one of the most important breakthroughs, with the lightning network opting for payment, while BEVM has chosen a more general intelligent contract scene.

長期來看,類似BVEM這種BTC Layer2解決方案和閃電網路一樣,對於比特幣長期發展都具有重要意義。隨之比特幣生態的發展,我們相信BTC Layer2解決方案也將成為比特幣社群長期探索的方向。

Long-term BTC Layer2 solutions, like BVEM’s BTC Layer2 solution and the Lightning Network, are important for the long-term development of the Bitcoins. As the bitcoins develop, we believe that the BTC Layer2 solution will also be the direction of the long-term exploration of the Bitcoins community.

正如以太坊創始人VitalikButerin近期在社群媒體上所說的:比特幣應該拓展各類Layer2解決方案,以增強的比特幣基礎層的同時來解決比特幣的拓展性問題。

As Vitalik Buterin, the founder of Etheria, recently said in social media: Bitcoins should expand the various types of Layer2 solutions to address the expansionary problems of bitcoins at the same time as the stronger bitcoins base.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论