美联储如期加息75个基点,是1980年代以来最大规模的连续两次会议加息,政策声明高度关注通胀风险,承认“近期的支出和生产指标已经走软”,但重申持续加息是适当的,美联储坚定致力于让通胀回落到2%的目标。两年期美债收益率升至3.11%,美股维持涨势,黄金和美元涨。

The Fed’s 75-point interest increase on schedule was the largest two consecutive increases since the 1980s. The policy statement focused heavily on the risk of inflation, acknowledging that “recent spending and production indicators have softened”, but reiterating that sustained interest increases are appropriate and that the Fed is firmly committed to the goal of bringing inflation back to 2 per cent. The rate of return on US debt rose to 3.11 per cent in the biennium, with the US share maintaining its upward trend, gold and the dollar rising.

美联储主席鲍威尔强调劳动力市场强劲和压低通胀的重要性,“必要时将毫不迟疑采取更大幅度的行动”。他还释放鸽派信号,称另一次非同寻常的大幅加息取决于数据,某个时点放慢加息节奏或适宜,令9月加息75个基点存悬念,美元跌至日低,美股大涨,两年期美债收益率跌穿3%。

Chairman Powell of the Federal Reserve stressed the importance of a strong labour market and low inflation, “there will be no hesitation to take even greater action, if necessary.” He also released the dove signal, saying that another unusually large increase in interest rates depended on data, slowing the pace of interest hikes at one point or more or was appropriate, stagnating 75 basis points of interest hikes in September, falling the dollar to a low day, rising United States shares, and falling the return on US debt by 3 per cent over the two-year period.

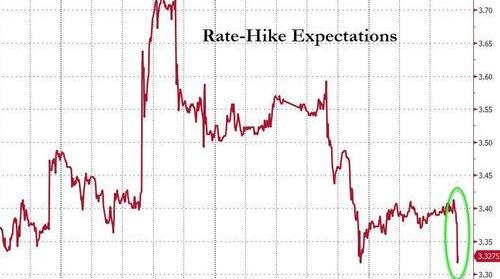

市场加息预期下调,交易员维持对明年起美联储降息的押注

Market interest increases are expected to go down and traders maintain their bets on the Fed's interest reduction next year.

周四将发布美国二季度GDP数据,市场目前认为可以暂时避免连续两个季度环比下降,即技术性衰退的窘境,鲍威尔也认为美国经济当下尚未处于衰退之中。科技巨头苹果、亚马逊和英特尔都将于明日盘后公布二季度财报,可能进一步决定股市动向。

The second quarter of US GDP data will be released on Thursday, and the market now considers it possible to temporarily avoid two consecutive quarters of decline, i.e., the technical recession, and Powell’s view that the US economy is not in the current recession. Both the technology giant Apple, Amazonian, and Intel will publish two quarters of their financial statements after tomorrow’s roundup, which may further determine stock market movements.

欧美经济数据好坏参半,高利率和高房价令美国楼市持续降温,6月成屋签约销售指数环比降8.6%,创2020年4月来最大降幅,同比跌19.8%为除疫情爆发初期之外的2011年9月来最低。上周购房贷款申请环比降1%、同比降18%,为连降四周。担心天然气断供和供应链危机,GFK研究所公布的德国8月消费者信心跌至-30.6的历史最低。但美国6月耐用品订单意外增超预期。

Euro-American economic data are mixed, with high interest rates and high house prices continuing to cool down the United States building market, with a 8.6% reduction in the index sales index in June, the largest decline since April 2020, with 19.8% being the lowest in September 2011 except in the early days of the outbreak. Last week, housing loan applications fell by 1%, 18%, and were rounded down. Fearing the natural gas supply and supply chain crisis, the GFK Institute announced that Germany’s consumer confidence fell to the lowest level in its history of -30.6 in August.

市场持续关注俄罗斯收紧向欧洲输送天然气,订单显示,周四俄罗斯经乌克兰输送的天然气将减少76%,俄罗斯天然气工业股份公司暗示北溪管线涡轮机可能会出现更多问题。周三经由北溪1号的供气量降至产能的20%,欧洲天然气飙升14%并上逼230欧元/兆瓦时,逼近历史最高。

The market continues to focus on Russia’s tightening of natural gas shipments to Europe, with orders showing a 76% reduction in Russian gas shipments via Ukraine on Thursday, and Russian gas industry shares suggest that there may be more problems with the North Creek pipeline turbines. Wednesday’s gas supply down to 20% of capacity, 14% of European gas surged and forced 230 euros/megawatts, the highest ever.

标普七周来首次收高于4000点,谷歌领涨通信股,科技止步三连跌,纳指100涨超4%创20个月最佳

For the first time in seven weeks, it's been over 4000, the Google-led Communications Unit, and the technology has dropped three times, and it's a 100-percent 4-percent plus 20-month-percent.

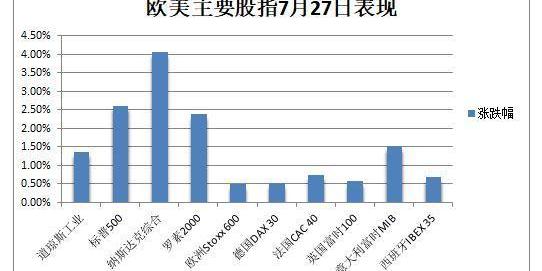

7月27日周三,在等待美联储公布加息决策之际,欧美不少企业二季报好于预期,帮助抵消了市场对鹰派加息引发衰退,以及俄气断供风险导致能源危机的担忧,欧美股市普涨。

On Wednesday, 27 July, while waiting for the Federal Reserve to announce its decision to raise interest, a number of companies in Europe and the United States reported better than expected, helping to offset the market's concerns about the recession caused by the Eagles'interest hike and the energy crisis caused by the Russian gas cut-off.

有分析称,微软、谷歌和德州仪器的财报激发了乐观希望,即大型科技股能够应对经济增速放缓。已公布财报的标普500成分股中七成盈利超预期,约80%的纳指100成分股业绩超预期。

Analysis suggests that the financial statements for Microsoft, Google, and Texas instruments have raised optimism that the large science and technology units will be able to cope with the slowdown in economic growth. Seventy-seven percent of the print 500 component shares that have been published are over-expected, and about 80% are over-expected for 100 component units.

科技股走强助推,美股集体高开,20分钟内标普500指数大盘便涨超1%,纳指高开近200点后也迅速涨超2%,道指高开超百点后保持涨势。盘初行业ETF普涨,科技股、网络股、半导体ETF均涨超2%。美联储加息决议公布前,美股均触及日高,石油股追随油价上涨,零售股反弹。

The S&T Unit has gone up, and the US stock has risen by more than 1% over 20 minutes, and the NA finger has risen rapidly by 2% after nearly 200 points, keeping up the upward trend after more than 100 points. In the beginning of the industry, the ETF has increased by more than 2%, the S&T Unit, the Network Unit, and the semiconductor ETF. Before the Fed's interest increase resolution was announced, the US shares had reached the height of the day, the oil stock had followed the rise in oil prices and the retail stock had rebounded.

美联储加息决策符合市场预期,美股涨幅持续扩大,特别是在鲍威尔“放鸽”后纷纷触及日高,收盘距离日高不远。道指最高涨近575点或涨1.8%,标普最高涨3%,纳指最高涨520点或涨4.5%,纳指100最高涨573点或涨4.7%,科技股居多的股指涨幅居前。罗素小盘股涨2.6%。

The Fed’s interest-added decision met market expectations, and the US stock increase continued to expand, particularly after Powell’s “vealing,” and the closing distance was as high as it was. The headlines rose by nearly 575 or 1.8%, the headlines by up to 3%, the nails by up to 520 or 4.5%, the 100 by up to 573 or 4.7%, and the large share in science and technology by 2.6%.

标普500指数收涨102.56点,涨幅2.62%,报4023.61点,时隔七周重新收于4000点上方,创6月9日以来收盘新高。道指收涨436.05点,涨幅1.37%,报32197.59点,重返3.2万点上方。纳指收涨469.85点,涨幅4.06%,报12032.42点,重返1.2万点上方。纳斯达克100指数涨4.3%,创2020年11月以来的20个月最大单日涨幅。罗素2000小盘股涨2.4%。

The standard 500 index rose by 102.56 points, by 2.62 per cent, to 4023.61 points, and was recollected at 4,000 points in seven weeks, up from 9 June. It rose by 436.05 points, by 1.37 per cent, and by 32197.59 points, back to 32,000 points. It rose by 469.85 points, by 4.06 per cent, and by 12032.42 points, back to 12,000 points. The NASDAQ 100 index rose by 4.3 per cent, the largest single-day increase in 20 months since November 2020.

标普11个板块齐涨,通信板块涨5.11%领跑,成分股谷歌涨超7.6%居前,科技板块涨超4%,可选消费板块涨3.9%,能源板块涨超2%,工业和金融板块涨超1.5%,公用事业涨0.1%垫底。

The pamphlet has grown by 11 blocks, communications by 5.11 per cent, composition by up to 7.6 per cent, technology by over 4 per cent, alternative consumption by 3.9 per cent, energy by over 2 per cent, industry and finance by over 1.5 per cent and utilities by 0.1 per cent.

美股全天上涨,鲍威尔“放鸽”后集体升至日高,标普一度涨3%,纳指涨4%,道指涨超570点

The United States stock rose all the time, and Powell went up to the sky after he "dived" with a three-per-cent rise, a 4-per-cent rise in the fingertips, and a 570-point rise in the fingertips.

明星科技股止步三日连跌,并集体收于日高附近。亚马逊涨5.4%,接近收复周一以来跌幅。苹果涨3.4%至5月6日来最高,奈飞涨6%,收复4月20日来全部跌幅。微软涨6.7%至6月8日来最高,谷歌母公司Alphabet涨7.7%,创年内第二高涨幅,接近收复上周四来跌幅。特斯拉涨6.2%。至5月6日来最高。“元宇宙”Meta在财报发布前涨6.6%,收复上周五以来跌幅,二季度收入大体符合预期,三季度收入指引不佳,将连续第二个季度下滑,盘后跌6%后跌幅收窄。

The star's technology unit fell three days ago, and was collectively close to Japan's heights. Amazons rose by 5.4 per cent, nearing the first week of recovery. Apples rose by 3.4 per cent to the highest date on 6 May, Nai flew by 6 per cent, and all fell on 20 April. Microsoft rose by 6.7 per cent to the highest point on 8 June, and Google Mothers' Alphabet by 7.7 per cent, the second largest increase in the year, nearing the fall of last week's fourth. Tesla increased by 6.2 per cent to the highest point on 6 May.

芯片股也止步三连跌。费城半导体指数涨4.8%,接连升破2800点和2900点两道整数位,6月9日来最高。明日发布财报的英特尔涨超3%,收复上周四以来过半跌幅。AMD涨超5%,英伟达涨7.6%,均接近收复上周四来跌幅。昨日财报被利好解读的德州仪器涨6.7%至6月2日来最高。高通在财报发布前涨超2%,二季度营收和盈利超预期,三季度指引不佳,盘后跌超3%。

The semiconductor index in Philadelphia rose by 4.8%, followed by 2800 and 2900, with the highest number since 9 June. Intel, who published the money tomorrow, increased by more than 3%, and recovered half the fall since last April. The AMD, which rose by more than 5%, and British Weida by 7.6%, was close to recovering its fall last Thursday. Yesterday's profitable Texas instrument rose by 6.7% to its highest on 2 June.

其他公布财报和变动较大的个股包括:

Other units with significant disclosures and changes include:

福特汽车准备裁员数千人以资助电动汽车发展,周三盘后公布的二季度盈利超预期,盘后涨5%。3C巨头百思买下调盈利预测,称高通胀正打击消费电子产品的需求,盘后一度跌超11%。

Ford's cut-off of thousands of people to finance the development of electric cars, published on Wednesdays in the second quarter of the week, increased by 5 per cent. Big 3C buys down profit forecasts, claiming that high inflation is fighting the demand for consumer electronics, and then falls by over 11 per cent.

波音盘初涨超4%后一度转跌,勉强收涨但抹去一周涨幅,二季度每股亏损超过预期且营收不佳,净利润同比骤降72%,国防部门疲软拖累商业飞机的利好业绩。公司重申今年自由现金流转正的指引,称处于恢复梦想客机交付的最后准备阶段,但也援引供应链和劳动力限制作为不利因素。

After a first increase of over 4%, the Boeing Disk experienced a turn-down, barely but without a week-long increase, with each share losing more than expected in the second quarter, a sharp fall in net profits of 72% over the same period, and a weak defence sector that dragged commercial aircraft’s positive performance. The company reiterated its guiding view of free cash flows this year, claiming that it was in the final stages of preparing for the resumption of the delivery of the dream passenger aircraft, but also citing supply chain and labour restrictions as adverse factors.

不少消费类股通过提价来支撑盈利。墨西哥风味餐厅连锁Chipotle涨16%至三个月新高,二季度营收逊于预期但盈利高于预期,将因更高的食品、包装和劳动力成本在8月再度提价。卡夫亨氏营收超预期并上调全年展望,但提价抑制了需求,最深跌超7%至六周低位。

In Mexico, the Chipotle chain rose by 16% to three months, the second quarter fell short of expectations but earned more than expected, raising prices again in August because of higher food, packaging, and labour costs. The Kafhorn Camp received more than expected and raised its year-round outlook, but price increases discouraged demand, falling at a low level of 7% to 6 weeks.

加拿大电商SaaS公司Shopify在昨日宣布全球裁员10%后,周三公布二季度亏损超预期且营收不佳,悲观预言三季度亏损继续扩大,称高通胀和利率上升将损害消费者支出,但股价涨超11%,昨日曾暴跌14%至两周低位,创5月5日来最大单日跌幅。

After yesterday's announcement of 10 per cent global layoffs by the Canadian electrician SaaS, Shopify, Wednesday's announcement of a two-quarter deficit that had exceeded expectations and failed to recover, pessimistic predictions that three-quarter losses would continue to grow, claiming that high inflation and interest rate rises would harm consumer spending, but stock prices rose by more than 11 per cent, dropping sharply from 14 per cent to two weeks, the largest single-day fall since 5 May.

音乐流媒体Spotify二季度亏损超预期,但营收利好且高端付费用户增长14%,股价最高涨17%至6月2日来最高。希尔顿全球二季度营收和盈利超预期,受益于旅游需求持续反弹,并上调全年和指引,股价涨7.5%。GPS设备制造商Garmin跌9%,连跌四日至六周新低,二季度盈利超预期但营收不佳,业绩受到健身领域表现逊色的负面影响。太阳能设备制造商EnphaseEnergy涨18%,在天然气飙升时欧洲市场增长提振二季报。

The music streaming media, Spotify, lost more than expected in the second quarter, but well-earned and high-end customers increased by 14%, with stock prices rising by up to 17% to 2 June. Hilton’s global second-quarter collection and profitability were expected to benefit from a sustained rebound in tourism demand and to increase stock prices by 7.5% throughout the year and guidelines. Garmin, the manufacturer of GPS equipment, fell by 9%, four to six weeks newly low, four to two quarters more than expected, but failed in the second quarter, negatively affected by poor performance in the area of fitness.

欧股方面,瑞信二季度巨额亏损近16亿瑞士法郎,净营收减少三成,CEO立即辞职,董事长否认将出售给美国道富银行或者考虑筹集资金的市场传闻,称三季度公布削减成本战略的详细计划,欧股涨超1%,美股涨超5%。德意志银行连续八季实现盈利超预期,上半年盈利为2011年来最佳,欧股跌1.6%,美股转涨跌1%。空客二季度盈利超预期,重申全年盈利和现金流指引,因供应链困境削减飞机交付数量目标并推迟加速生产的计划,欧股涨超1%,但美股跌超1%。

On the euro-based side, the CEO immediately resigned, denying that it would be sold to the United States Bank of Do-fu, or that it was considering raising funds, the chairman of the board denied that the detailed plan to reduce costs had been announced in the third quarter, raising the euro-based share by more than 1%, and the US share by 5%. In the eighth consecutive season, the Deutsche Bank had achieved a profit-making over-expected, with the first half of the year having been the best in 2011, with the share falling by 1.6% and the US share by 1%. Airfarers in the second quarter had a profit over-expected, reiterating their year-round profit and cash flow guidelines, and a 1% increase in the euro-based share over 1%, owing to supply chain constraints, reducing the number of aircraft delivered and delaying plans to accelerate production.

此外,报道称激进投资者ElliottManagement持股PayPal,后者涨超12%至6月7日来最高。“木头姐”控制基金今年来首次抛售Coinbase,不过据称正面临SEC调查的Coinbase涨超11%。仿制药巨头TevaPharmaceutical涨超28%至6月3日来最高,与监管机构达成和解协议。

In addition, there are reports that radical investors Elliott Management held shares in PayPal, which rose by more than 12% to the highest level on 7 June. For the first time this year, the Wood Sisters Control Fund sold Coinbase, although allegedly facing an increase of over 11% in Coinbase under the SEC investigation.

热门中概追随大盘涨势。中概ETFKWEB和CQQQ涨超2%,纳斯达克金龙中国指数涨1.7%。纳斯达克100四只成份股中,京东涨0.6%,网易涨1.9%,百度涨2%,拼多多跌0.3%。其他个股中,阿里巴巴涨1.3%,腾讯ADR微跌,B站涨4.5%,蔚来与小鹏汽车涨近2%,金山云涨2.7%,在港交所提交上市申请。新东方Q4财报不及预期,营收同比跌56.8%,但股价涨超7%。

Among the other shares, Ali Baba has risen by 1.3%, ADR has fallen by 4.5%, Station B has risen by almost 2%, Nakdak Kinglong has risen by 2.7%, and Hong Kong has submitted market applications. The New East Q4 returns have fallen by 56.8%, but the stock price has risen by over 7%.

欧股在美联储加息决策公布前收盘,泛欧Stoxx600指数收涨0.49%,旅游和休闲股涨3%领涨,大多数板块和主要国家股指均收高,欧洲银行股指数一度触及一周新高。尽管被评级机构标普下调信用展望,意大利股指仍收涨1.5%领跑,意大利银行板块涨超3.5%,俄股也收高。

The euro closed before the Fed’s interest increase decision was announced, with the Pan-European Stoxx 600 index rising by 0.49%, the tourism and leisure stock rising by 3%, the majority of the plates and major national shares rising, and the European banking stock index reaching a week of new heights. Despite the rating agency’s downgraded credit outlook, Italian shares rose by 1.5%, Italian bank blocks by over 3.5%, and Russian shares.

分析指出,谷歌、微软和德州仪器均公布了两位数百分比的二季度收入增长,并对未来几个月保持乐观,让一直担心科技行业下半年将陷入低迷的投资者感到放心,缓解了对经济放缓损害电子产品需求和广告支出的担忧。不过,谷歌和微软都提到了汇率的负面影响和宏观环境不确定性。

According to the analysis, Google, Microsoft, and Texas instruments have announced two-quarter double-digit revenue growth and remain optimistic for the coming months, reassuring investors who have been worried that the science and technology industry will fall into a slump in the second half of the year, alleviating concerns that the economic slowdown will undermine demand for electronics and advertising spending. However, Google and Microsoft have both mentioned the negative effects of exchange rates and macro-environmental uncertainties.

CFRAResearch首席投资策略师SamStovall指出,企业盈利增长预期将继续下滑,经济低迷时期通常表现较好的科技行业也难以幸免,所有消费者信心指标均已从去年中旬的峰值急剧恶化。IndosuezWealthManagement首席投资官VincentManuel也称,大型科技和奢侈品公司财报强劲,但与疲软的宏观情绪存分歧,工业和非必需消费品公司比科技和医疗保健公司更能反映压力。

According to CFRAResearch’s chief investment strategist, Sam Stavall, corporate profitability growth is expected to continue to decline, and the science and technology industry, which usually performed better during periods of economic downturn, has experienced a sharp deterioration in all consumer confidence indicators from its peak in mid-year. Vincent Manuel, Chief Investment Officer, Indosuez HealthManagement, also claims that large technology and luxury companies have strong financial reporting, but that there are differences with weak macro-emotions, and that industrial and non-essential consumer goods companies are more responsive to pressures than technology and health-care companies.

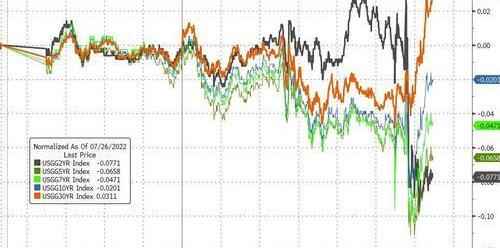

鲍威尔“放鸽”令短端美债收益率暴跌,两年/30年期曲线摆脱倒挂,长债收益率转涨

Powell “Doves” plunged short-end US debt returns, the two-year-30-year curve went off backwards, and the long-debt rate went up.

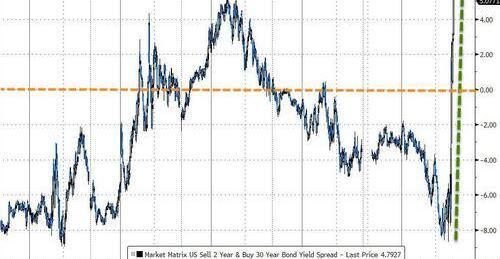

美联储决议宣布前,长端美债收益率下跌而短端涨,两年/10年期收益率曲线倒挂幅度达30个基点,突显市场对鹰派加息引发衰退的担忧,两年/5年、两年/30年和5年/10年期曲线均倒挂。有分析称,债市对经济疲软的定价明显高于被企业财报提振的股市。

Prior to the announcement of the Federal Reserve resolution, the long-term US-debt rate of return fell and rose sharply, with a two-year 10-year yield curve of up to 30 basis points, highlighting the market’s concern about the recession caused by the Eagles’ interest hike, with the two-year five-year-five, two-year/30, and five-year-ten-year curves collapsing. According to analysis, debt markets have significantly higher prices for weak economies than equity markets that have been boosted by corporate returns.

10年期美债收益率在美联储加息公布后跌幅翻倍至逾6个基点,日低下逼2.72%,刷新两个月最低,与两年期收益率倒挂幅度走阔至32个基点,刷新数十年最深;鲍威尔“放鸽”后,10年期基债收益率跌幅收窄,徘徊2.79%的平盘位。30年期长债收益率则最高涨7个基点至3.08%。

The ten-year rate of return on US debt doubled to more than six basis points after the Federal Reserve's interest increase was announced, with a low daily rate of 2.72 per cent, the lowest two-month period, and the reverse two-year rate of return to 32 basis points, the deepest in decades; after Powell's “flailing”, the ten-year rate of return on base debt shrunk, hovering by 2.79 per cent. The 30-year rate of return on long-term debt rose by a maximum of seven basis points to 3.08 per cent.

鲍威尔“放鸽”后长端美债收益率加速反弹,两年期收益率转跌并失守3%

Powell's long-end US debt rate rebounded faster, falling and losing 3 per cent in the biennium.

对货币政策更敏感的两年期收益率在美联储加息公布后涨幅扩大至6.5个基点,日高上逼3.11%,收复上周五以来过半跌幅,鲍威尔“放鸽”后迅速转跌并失守3%关口,日内最深跌超8个基点,与30年期收益率曲线结束倒挂,两年/10年期关键收益率曲线倒挂幅度显著收窄。

The two-year rate of return, which was more sensitive to monetary policy, expanded to 6.5 basis points after the Fed's interest increase was announced, pushing it to 3.11 per cent daily, recovering the half-deep fall since last Friday, and Powell's “vealing” quickly slipped and missed the 3 per cent mark, falling to the bottom of eight basis points in the day, collapsing to the end of the 30-year yield curve, with the two-year to 10-year key yield curve shrunk significantly.

两年/10年期美债收益率倒挂幅度从数十年最深收窄,两年/30年期息差脱离倒挂

The two-year-to-ten-year rate of return on United States debt has narrowed from the deepest in decades, with the two-year/30-year spread out of reverse

欧债收益率普涨,短端德债收益率涨幅突出,两年期德债收益率升超10个基点,10年期基债收益率升超2个基点,10年期英债收益率升超4个基点。10年期意大利国债收益率一度跃升10个基点,但衡量风险溢价的对德国基债息差走阔至248个基点,重返一个多月来最高。

The rate of return on European debt rose widely, with a sharp increase in the rate of return on short-term German debt, which rose by more than 10 basis points in the biennium, the rate of return on German debt by more than 2 basis points in the 10-year period and the rate of return on British debt by more than 4 basis points in the 10-year period. The rate of return on Italian national debt jumped by 10 basis points in the 10-year period, but the difference in interest on German base debt that measured the risk premium rose to 248 basis points, returning to the highest level in more than a month.

美国油储降超预期、出口新高,油价反弹超3美元,美油升破98美元,欧美天然气冲高回落

U.S. oil reserves are above expectations, new exports are high, oil prices are rebounding by over $3, oil is rising by $98 and gas from Europe and America is falling.

美国油储降超预期,供应担忧超过对美国加息导致衰退的恐慌,国际油价上涨。WTI9月期货收涨2.28美元,涨幅2.40%,报97.26美元/桶,创一周最高。布伦特9月期货收涨2.22美元,涨幅2.13%至106.62美元。鲍威尔“放鸽”提振风险资产,收盘后油价继续突破日高。

In the United States, oil reserves fell faster than expected, supply concerns exceeded the panic over the recession caused by the increase in interest rates in the United States, and international oil prices rose. WTI’s futures increased by $2.28, by 2.40 per cent, reporting $97.26 per barrel, the highest in a week. Brent’s futures increased by $2.22, or between $2.13 and $106.62, in September.

美油WTI最高涨3.57美元或涨3.8%,上破98美元。国际布伦特9月期货最高涨3.46美元或涨3.3%,升破107美元,10月期货最高涨3.38美元或涨3.4%,重返100美元关口并升破102美元。

Merit WTI rose by up to $3.57 or 3.8 per cent, up to $98. International Brent raised its futures by up to $3.46 or 3.3 per cent in September, $107 or $3.38 or 3.4 per cent in October and $102 in October.

油价随同风险资产走高,集体反弹超3美元,美油升破98美元,收复昨日跌幅

Oil prices went up with risky assets, collectively rebounded over $3, oil went up $98 and recovered yesterday's fall.

据美国能源信息署EIA官方统计,7月22日当周原油库存骤降452万桶,是预期降幅的三倍多,汽油和精炼油库存均下降,美国原油出口增长21%至455万桶/日的历史新高,主要输向欧洲。

According to the official statistics of the United States Energy Information Agency EIA, there was a sharp drop of 4.52 million barrels of crude oil stocks in the week of 22 July, which is more than three times the expected decrease, a decline in both petrol and refined oil stocks, and a historically high increase of 21 per cent to 4.55 million barrels per day in United States crude oil exports, mainly to Europe.

俄罗斯持续收紧向欧洲出口天然气,欧气连涨六日逼近历史新高。欧洲基准的TTF荷兰天然气期货尾盘涨超1%,盘中曾大涨14%,且达到往年同期正常水平的10倍以上;英国天然气期货尾盘涨超4%,盘中曾涨近12%。德国未来一个月电价盘中涨近10%,未来一年电价尾盘转跌2%,昨日曾触及历史最高。美国天然气也冲高回落,收跌3.4%,昨日曾创14年新高。

Russia continues to tighten its exports of natural gas to Europe, with a six-day rise in oil and gas. The European benchmark, TTF Dutch gas futures, has risen by more than 1 per cent, with a 14 per cent increase, and has reached more than 10 times normal levels over the same period in previous years; the British gas futures, with a 4 per cent increase and nearly 12 per cent increase in the disks. Germany will increase by nearly 10 per cent in the next month, and will fall by 2 per cent in the next year’s finals, reaching the highest level in history last year.

欧美天然气尾盘均冲高回落,欧洲天然气保持涨势,美国天然气转跌

The Euro-American gas tailings are all up and down, Europe's gas is up and down, and America's gas is down.

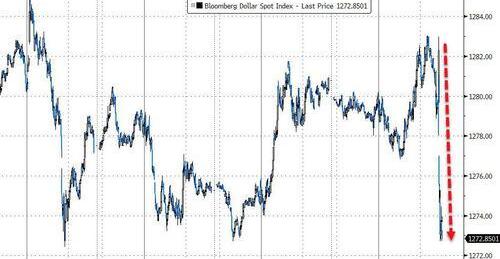

“鸽声大作”令美元跌破107,非美货币普涨,欧元英镑澳元涨超1%,比特币上逼2.3万美元

"Doves" broke the dollar by 107, non-United States currencies rose by more than 1 per cent, and the euro pound went up by $230,000 in bitcoins.

美联储加息宣布前夕,衡量兑六种主要货币的一篮子美元指数DXY小幅下跌,仍站稳107上方,7月以来累涨约2.3%,主要受到鹰派加息的预期提振。鲍威尔“放鸽”称不排除未来放慢加息节奏后,美元跌幅扩大且失守107关口,日内最深跌0.9%,基本回吐周二涨幅。

The dollar index of DXY, which measures a basket of six major currencies, fell slightly on the eve of the Fed’s interest increase, and remained stable at 107, rising by some 2.3% since July, largely boosted by the expectation of an eagle increase. Powell’s “flailing” said that it was not precluded from slowing down the rate increase in the future, the dollar’s decline widened and lost 107 points, falling by 0.9% in the day, with a basic fall on Tuesday.

“鸽声大作”令美元跌破107,日内最深跌0.9%,基本回吐周二涨幅。

The “doves” fell by 107 and the dollar fell by 0.9 per cent at the lowest point in the day.

非美货币涨幅扩大。欧元兑美元涨超1%或超百点,尾盘重上1.02,昨日跌1%曾创两周来最大跌幅,俄罗斯停供天然气的担忧令欧洲经济衰退危险升级。英镑兑美元张1.3%或超160点,升破1.21,刷新月内高位,但高盛预言英央行的加息谨慎立场将在未来三个月利空英镑。日元兑美元在美联储加息后重回137上方。澳元兑美元涨1%,但对该国加息50个基点的市场押注降温。

The euro rose by more than 1% against the United States dollar or 100%, the tail was up by 1.02%, the fall of 1% yesterday was the largest fall in two weeks, and Russia’s fears of a halt in the supply of natural gas led to a dangerous escalation of the recession in Europe. The pound dollar was 1.3% or more against the dollar, rising by 1.21%, and the new month was high, but Goldman Sachs predicted that the British Central Bank’s interest hike would run out of pounds sterling over the next three months. The yen returned to 137 when the dollar was raised by the Federal Reserve. The Australian dollar rose by 1% against the dollar, but the market price of the country’s 50 basis points was heated.

主流加密数字货币普涨,且不少呈两位数百分比的大幅反弹。市值最大的龙头比特币涨超9%,重返2.2万美元上方,一度触及2.3万美元关口。市值第二大的以太坊涨近16%并升破1600美元。

Mainstream encrypted digital currencies are on the rise, and a lot of these rebounds in double-digit percentages. The highest-market leader, Bitcoins, rose by more than 9%, returned to over $22,000, once reaching the twenty-three million threshold.

黄金止步两连跌,现货黄金升至1740美元,伦铜连涨四日上破7600美元,小麦转跌

Gold has fallen in two consecutive steps, cash gold has risen to $1740, lronco has fallen in four days at $7,600, and wheat has fallen.

COMEX8月黄金期货收涨约0.1%,报1719.10美元/盎司,止步两日连跌并上逼1720美元关口。现货黄金在美联储决议公布前止跌转涨,在下逼1710美元之后重返1720美元上方,美联储决议公布和鲍威尔“放鸽”之后,涨幅迅速扩大并上破1740美元,日内最高涨23美元或涨1.3%。

In August, the gold futures of COMEX rose by about 0.1%, reporting $1719.10/ounces, and stopped two days and forced $1720 at the end. Cash gold fell before the Federal Reserve resolution was issued and returned to the top of $1720 after pushing $1710. After the Federal Reserve resolution was announced and Powell was “vealed”, the increase rapidly expanded and broke to $1740, up to $23 or 1.3% per cent per day.

美联储决议公布和鲍威尔“放鸽”之后,现货黄金涨幅迅速扩大至23美元,上破1740美元

Following the release of the Federal Reserve resolution and Powell's “flailing”, the increase in cash gold was rapidly expanded to $23, and $1740 was broken.

美元走弱和需求前景改善,令伦敦基本金属连续两日多数收涨。伦铜涨100美元或涨1.3%,收盘上破7600美元整数位,连涨四日刷新两周高位,也与投机者空头回补有关,昨日跌近3%的伦镍收涨242美元或涨超1%。但昨日涨0.9%的伦铅跌0.5%,伦锡也跌0.5%且连跌两日。

The weakening of the dollar and improved demand prospects have led to most of the rise in basic metals in London for two consecutive days. Bronze has risen by $100 or 1.3%, with an entire closing of $7,600, with a four-day new two-week high, and is also associated with speculators refilling, with Lon Nickel, which fell by nearly 3% yesterday, rising by $242 or more than 1%.

不过,花旗仍预言铜价将在6至9个月内跌至6600美元,建议未来几周卖空铜和镍,理由是欧洲衰退、全球经济减速和稳健的供应增长,将推动上述两种金属的现货市场出现供应过剩。

However, the flag still predicts that copper prices will fall to $6,600 in six to nine months, and recommends the sale of empty copper and nickel in the coming weeks on the grounds that the recession in Europe, the global economic slowdown and robust supply growth will contribute to oversupply in the spot markets for both metals.

农产品期货方面,ICE原糖期货跌至一年低点,部分由于巴西中南部地区的7月上旬产量强于预期。芝加哥大豆期货创两周新高,玉米一周新高,对美国中西部炎热干燥天气的担忧重回市场。人们愈发质疑乌克兰海上谷物出口协议能否实施,小麦期货转跌1.8%,昨日曾涨超4.5%。

In terms of agricultural futures, ICE's raw sugar futures have fallen to a low of one year, partly because of higher than expected production in early July in the south-central region of Brazil. Chicago soybean futures are two weeks high, corn is one week high, and concerns about hot and dry weather in the mid-west of the United States are returning to the market.

本文来自华尔街见闻,欢迎下载APP查看更多

It's from Wall Street. Welcome to the APP for more.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论