行情不好如何购买稳定增长的稳定币?稳定币增值攻略!加密货币市场今日再次遭遇重挫,虽然比特币自身的跌幅现已收窄至不足 1% ,但山寨币板块却随着 BTC 的短线出现了集体跳水行情,SOL、PEPE、ORDI、ARB、TIA 等不同赛道的代表级山寨币均录得了超 10% 甚至是 20% 的跌幅。

How do you buy stable and stable currencies? Stabilizing the value of the currency. The crypto-currency market has again suffered a major setback today. Although Bitcoin itself has now shrunk to less than 1% & nbsp, the tiles of the mountain coins show a collective dive with BTC short lines, with SOL, PEPE, ORDI, ARB, TIA, etc. recording over 10 per cent, or even 20 per cent, of the fall in representative mountain mounds.

虽然当前的二级市场可谓是“腥风血雨”,但对于普通投资者而言,除了直接下场交易之外,其实还有着另一条相对缓慢但胜在稳健的操作模式 —— 通过各大 DeFi 协议,利用稳定币去实现相对低风险、高收益的生息策略。

Although the current secondary market is called & ldquo; blizzard & rdquao; but for ordinary investors,

在下文中,高手将结合自身操作经验,为大家推荐多条网络上的多个稳定币生息策略,这些策略在操作层面虽然都相当简单,但普遍都可实现 10% 甚至 20% 的稳健收益,且部分策略还可同步交互一些未发币的底层网络或 DeFi 协议,实现“一鱼多吃”。

In the following context, the masters, in combination with their own operational experience, will recommend multiple strategies for stabilizing the interest rate on multiple networks, which, while relatively simple at the operational level, are generally able to achieve 10 per cent, or even 20 per cent, of the steady benefits, and some of the strategies can simultaneously interact with some of the bottom networks or the DeFi protocol to achieve & ldquo; one fish to eat & rdquao;

需要强调的是,任何 DeFi 协议都无法完全避免合约风险,部分 DeFi 协议因其业务模式还会面临一定的流动性风险、组合性风险等等,因此大家在选择执行具体某种策略之时,请务必事先了解各项具体风险,且应尽量做到不要“将鸡蛋放在同一个篮子里”。

It should be emphasized that none of the DeFi agreements of

今天脚本之家小编给大家分享的是行情不好如何购买稳定增长的稳定币?稳定币增值攻略了,希望大家喜欢!

Today's Script House editor shared the idea of how to buy a stable currency for steady growth. The value of the stable currency has been increased. I hope you like it!

操作方式:在 Ethena 官网直接先行购入 USDe,再通过质押兑换成 sUSDe;

Operation: at Ethena direct acquisition of USDE by the network and conversion to SUSDE via pledge;

实时收益率: 17.5% ;

Real-time rate of return: & nbsp; 17.5% & nbsp;

收益构成(即可获得的奖励代币类型):sUSDe 升值(可兑换更多 USDe);

Income composition (type of incentive available): sUSDE appreciation (more convertible USDE);

其他潜在收益:ENA 二期空投;

Other potential benefits: ENA II airdrops;

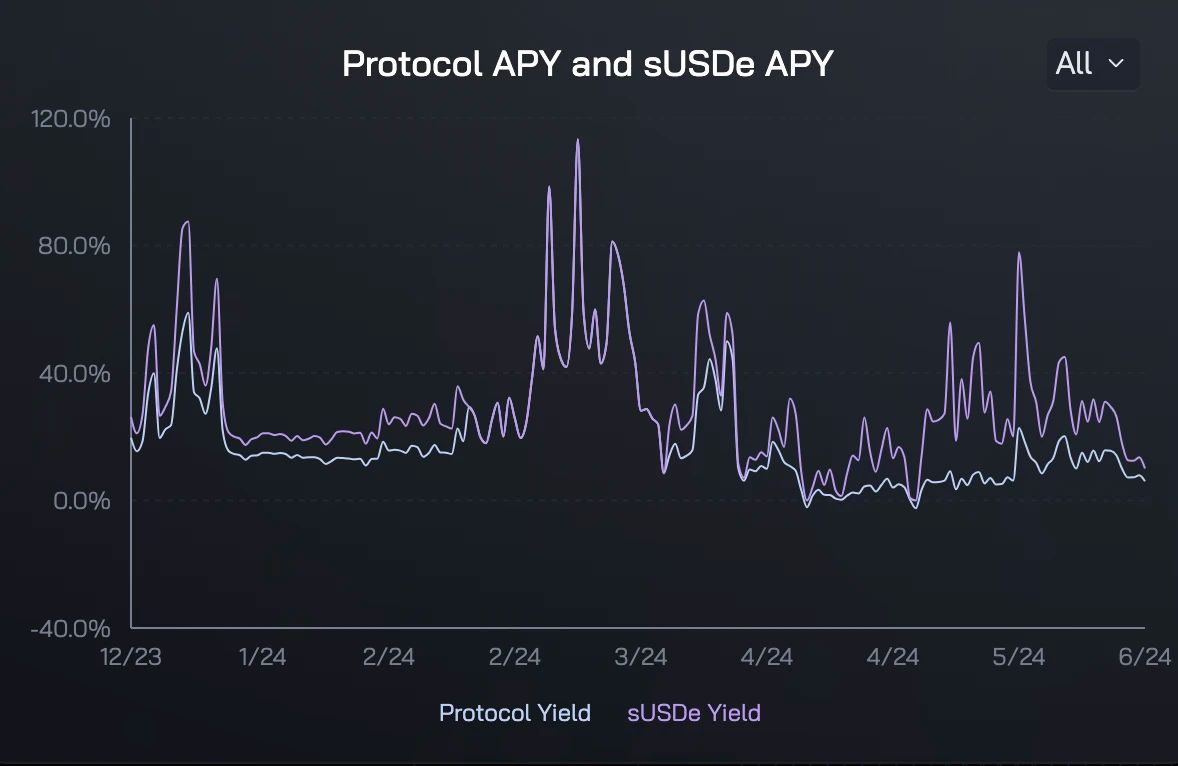

备注:Ethena 的 sUSDe 是当前加密货币市场内成规模(数十亿美元级别)的稳定币矿池的中 APY 最高的收益机会,远高于 MakerDAO 的 sDAI 等代币化国债产品。sUSDe 的实时 APY 会随着市场的杠杆状况而有所变化,但就过往波动记录来看一直都稳定处于较高水平。此外,通过 sUSDe 还可以累积 Ethena 的二期空投凭证 sats(积累效率较低,但胜在收益稳定),借此获取 ENA 的下一次空投。

Note: The SUSDE of Ethena is the highest yield of a stable currency pool in the current encrypted currency market (billions of United States dollars class), much higher than the SDAI and other currency-based national debt products of MakerDAO. The real-time APY of SUSDE will change with market leverage, but will remain stable at a higher level for past fluctuations. Also, SUSDE will build up Ethena’s two-phase air drop documents (less efficient but with steady returns) to get the next ENA.

操作方式:在 Gearbox 官网通过 Earn 存入各种类型的稳定币;

Operation: at Gearbox posting of various types of stable currency via Earn;

实时收益率:除 USDT 外,普遍大于 10% ;

Real-time rate of return: generally greater than 10% & nbsp, except for USDT;

收益构成:稳定币为主,辅以少量 GEAR 激励;

(a) Income composition: a stable currency dominated by a small number of GEAR incentives;

备注:Gearbox 作为杠杆型借贷协议,本身其实支持更高收益率的杠杆型玩法(Farm),但该操作对于普通用户而言具有一定的操作门槛,所以在此更建议相对简单的存款玩法(Earn,本质上就是借贷存款)。之所以推荐该矿池,是因为 Gearbox 胜在收益构成系以稳定币为主,因此其实际收益相对而言会更加稳定,不会出现因激励代币暴跌而导致的实际收益大幅缩水状况。

Note: Gearbox, as a leverage-lending agreement, actually supports a higher yield-rate leverage game (Farm), but the operation has a certain operational threshold for ordinary users, so it suggests a relatively simple deposit-playing approach (Earn, essentially a loan deposit). The pond is recommended because the Gearbox is more stable in terms of the composition of the proceeds, so that the real gains are not substantially reduced as a result of the incentive for a currency to fall.

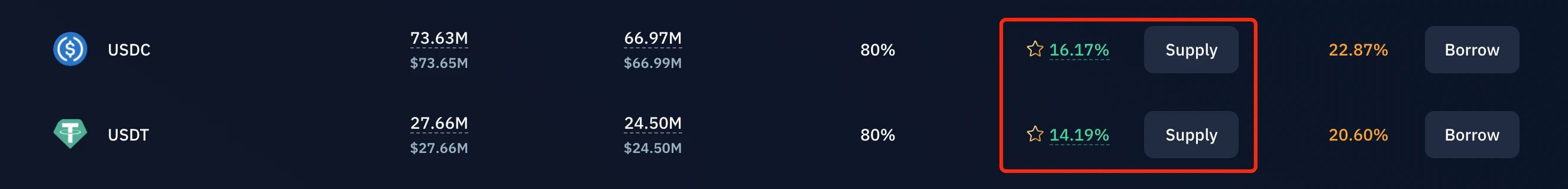

操作方式:在 marginfi 或 Kamino 上存入 USDT 或 USDC 生息;

Method of operation: at or deposited in USDT or USDC for life;

实时收益率: 12% - 16% ;

Real-time rate of return: & nbsp; 12% - 16% & nbsp;

收益构成:稳定币;

(a) Income composition: a stable currency;

其他潜在收益:marginfi 空投及 Kamino 二期空投;

Other potential benefits: Marginfi airdrop and Kamino II airdrop;

备注:marginfi 和 Kamino 分别是 Solana 之上第一、第二的借贷协议,由于 Solana 生态的交易较为活性,该生态之上的借贷需求也普遍高于其他生态,因此 marginfi 和 Kamino 之上的借贷收益率也会普遍高于其他生态的借贷协议。此外,marginfi 尚未 TGE,Kamino 的二期积分活动也在进行中,二者都具备一定的潜在空投激励预期。

Note: Marginfi and Kamino are the first and second loan agreements above Solana, respectively. Because of the more dynamic nature of the Solana eco-economy transactions and the generally higher demand for borrowing above other ecosystems, and Marginfi and Kamino have generally higher lending returns than other eco-lending agreements. Moreover, Marginfi is not yet TGE, and Kamino’s two-phase credits are in progress, both of which have some potential investment incentive expectations.

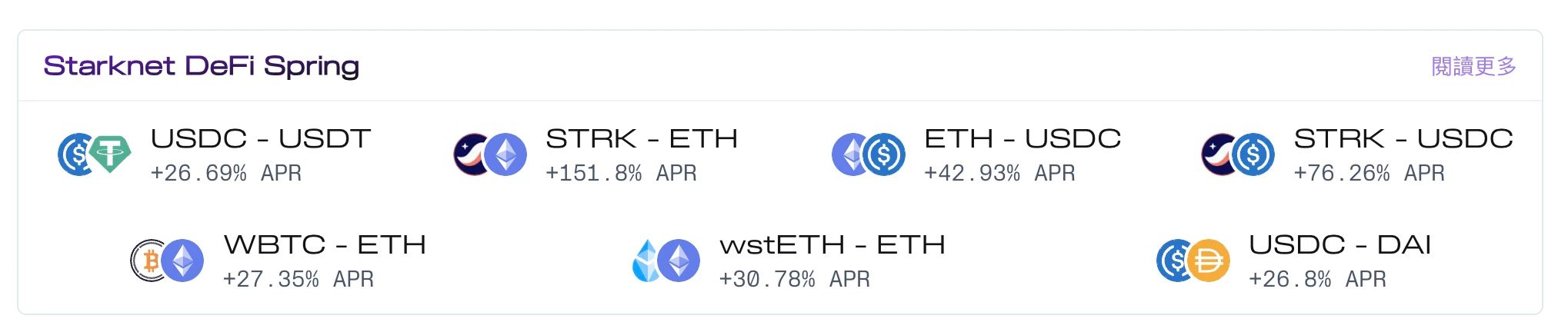

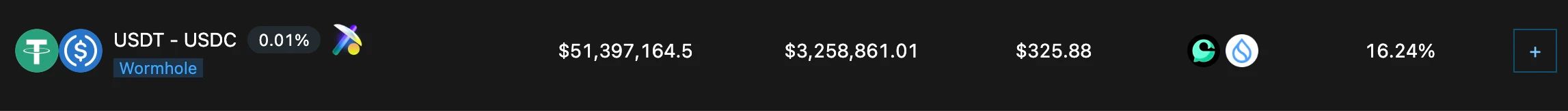

操作方式:在 Ekubo 官网利用 USDT 和 USDC 组成交易对,参与做市;

Operation: at Ekubo network using USDT and USDC to organize transactions and participate in the market;

实时收益率: 26.69% ;

Real-time rate of return: 26.69% & nbsp;

收益构成:STRK 为主,原生做市收益为辅;

(a) Income composition: STRK is the main source of income, supported by municipal income;

备注:受益于 Starknet 的 DeFi Spring 激励计划,当前在 Starknet 上参与各项 DeFi 协议的收益率都很可观,其中 Ekubo 作为当前该生态流动性及交易量最大的 DEX 协议,在安全性及收益率的平衡方面会是个较好的选择。

Note: The DeFi Spring incentive scheme, which benefits from Starknet, currently has a significant rate of return on participating in the DeFi agreements at Starknet, in which Ekubo, as the current eco-mobility and trade-rich DEX agreement, would be a better option in terms of security and a balance of returns.

操作方式:在 zkLend 及 Nostra 上存入 USDT 或 USDC 生息;

Operation: in and

实时收益率: 20% 左右;

Real-time rate of return: & nbsp; around 20%;

收益构成:STRK 为主,稳定币原生收益为辅;

(a) Income composition: STRK is predominant and the stability of the raw earnings of the currency is supported;

备注:基础款借贷协议,类似于 Solana 上的 marginfi 和 Kamino,但收益构成却主要由 STRK 的激励构成(这一点与 Ekubo 类似),看好 STRK 后市表现的用户可酌情参与。

Note: Foundation lending agreements, similar to on Solana; marginfi and Kamino, but the composition of the proceeds consists mainly of STRK incentives (which are similar to Ekubo), with the participation of users of post-STRK market performance as appropriate.

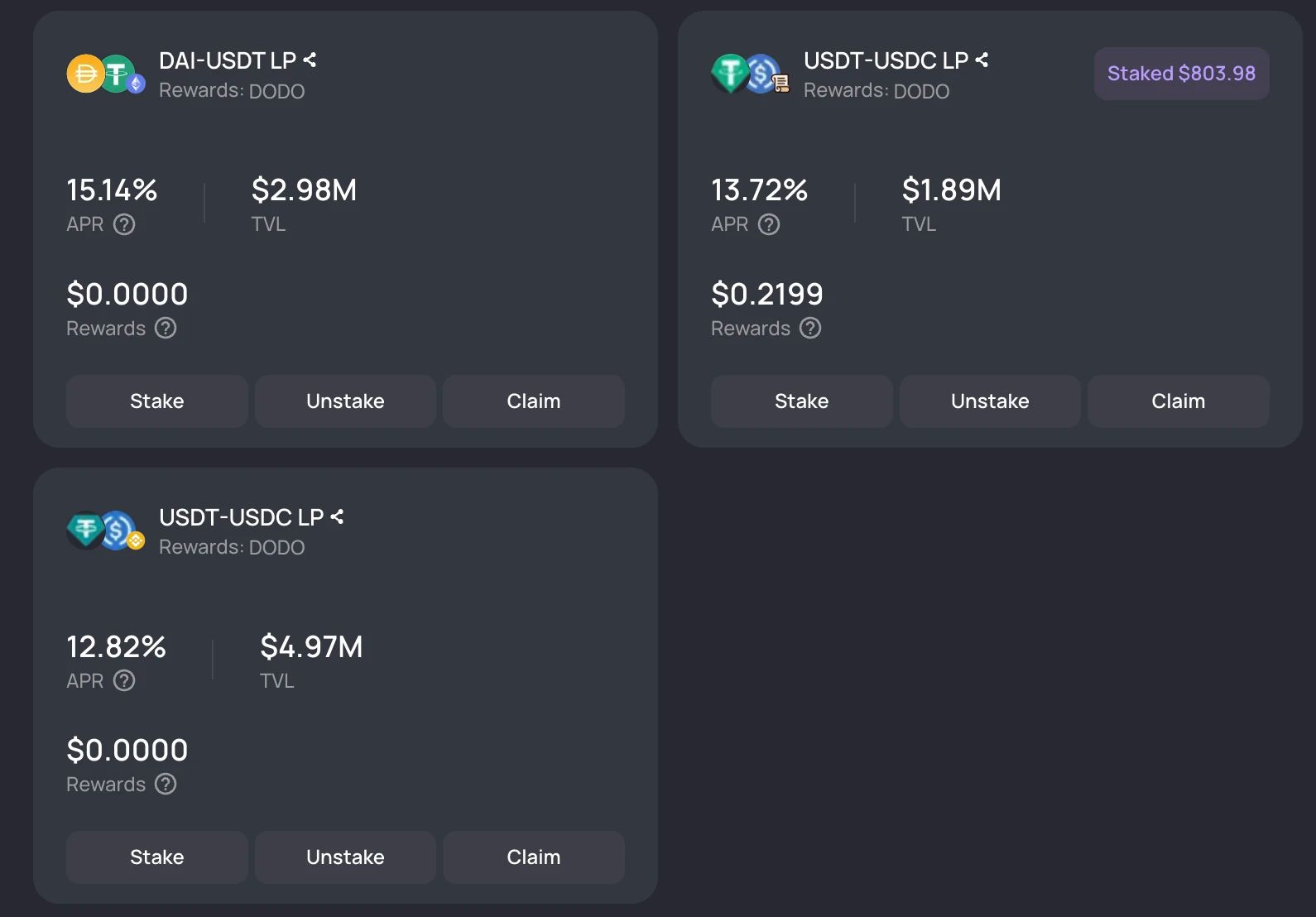

操作方式:在 DODO 官网利用 DAI、USDT、USDC 等组成交易对,参与做市;

Operation: at DODO participation in the market using the network to form transactions such as DAI, USDT, USDC etc.;

实时收益率: 12% - 15% ;

Real-time rate of return: & nbsp; 12% - 15% & nbsp;

收益构成:DODO 为主,稳定币原生收益为辅;

(a) Income composition: DODO, which is supported by the stabilization of the raw earnings of the currency;

其他潜在收益:Scroll 空投激励;

Other potential benefits: Scroll Airdrop Incentive;

备注:随着各大 Layer 2 接连发币,尚未发币的 Scroll 也迎来了更多的关注及流动性。综合 Scroll 上的各大 DeFi 协议来看,DODO 作为老牌 DEX 在安全性方面相对值得信赖,且受益于 DODO 自身的流动性激励计划,其稳定币交易对也有着较高的 APY 表现,因此推荐用户将其作为交互 Scroll 的一大阵地。

Note: With the large Layer 2 successive coins, more attention and liquidity has been generated by Scroll, who has not yet done so. The major DeFi agreements on the consolidation of Scroll suggest that DoDO, as the old DEX, is relatively trustworthy in terms of security and benefits from the DODO’s own mobility incentive scheme, and that its steady currency transactions have a high AAY performance, and it is therefore recommended that users use it as a major position for interacting with Scroll.

操作方式:在 Echelon 上存入各种稳定币生息;

Operating method: In Echelon deposited into various stable currency deposits;

实时收益率: 11% - 17% ;

Real-time rate of return: & nbsp; 11% - 17% & nbsp;

收益构成:稳定币原生收益加 APT 激励收益;

(a) Income composition: stabilization of raw earnings in currencies plus APT incentives;

其他潜在收益:Echelon 空投收益;

Other potential benefits: Echelon air drop earnings;

备注:Echelon 是当前 Aptos 上 TVL 排名第二的借贷协议,仅次于 Aries Markets,但或许是由于入选了 Aptos 激励计划,当前该平台的综合 APY 要显著高于后者。此外,Echelon 当前已上线了积分计划,这也意味着当下参与该协议还有着一定的潜在空投预期。

Note: Echelon is the second-largest loan agreement on top of TVL on the Aptos, after Aries Markets, but perhaps because of the selection of the Aptos Incentives, the platform's current comprehensive APY is significantly higher than the latter. Moreover, Echelon is now on the line, which means that there are some potential airdrop expectations for participating in the agreement.

操作方式:在 Cetus 上利用 USDT、USDC 等组成交易对,参与做市;

Method of operation: make up transactions on Cetus using USDT, USDC, etc., and participate in the market;

实时收益率: 16.28% ;

Real-time rate of return: & nbsp; 16.28 & nbsp;

收益构成:SUI 激励为主,CETUS 和稳定币原生收益为辅;

(a) Income composition: SUI main incentives, supported by CETUS and stable currency revenues;

备注:Sui 之上最大的 DEX 协议,收益主要来源于 Sui 给予的生态激励。

Note: The largest DEX agreement over Sui, the main source of revenue is the ecological incentive given by Sui.

以上即为我们当前比较推荐的部分稳定币生息策略。

These are some of the stabilization strategies that we currently recommend.

出于风险控制以及复刻难度的考虑,上述策略仅覆盖了一些较为简单的 DeFi 操作,所涉及的也只是一些较为基础的质押、存款、LP 等操作,但可获取的潜在收益还是要普遍高于交易所内的被动理财生息。对于当下不知该如何进行二级市场操作,且又不想让稳定币白白闲置的用户而言,可酌情考虑上述策略。

For the sake of risk control and the difficulty of repeating it, these strategies cover only a few simpler deFi operations, and only some more basic pledge, deposit, LP, etc., but the potential gains are generally higher than the passive financial benefits of the exchange. For users who do not know how to operate a secondary market at the moment, and who do not want to leave the stable currency idle, these strategies could be considered as appropriate.

最后需要再次强调的是,DeFi 世界是一个永远伴随着风险的黑暗森林,各位在操作前请务必事先了解风险,DYOR。

Finally, it is important to stress once again that the world of DeFi is a dark forest that always carries with it risks, and you must be aware of the risks before you operate, DYOR.

以上就是脚本之家小编给大家分享的行情不好如何购买稳定增长的稳定币?稳定币增值攻略的详细介绍了,希望大家喜欢!

And that's how you buy a stable currency of steady growth, which is not well shared by the Script House editor. A detailed description of the stabilization value-added strategy, I hope you like it!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论